Daily Caller

Trump’s ‘Drill, Baby, Drill’ Agenda Will Likely Take On An Entirely New Shape

From the Daily Caller News Foundation

By David Blackmon

During his campaign and since taking office, President Donald Trump often repeated his desire to bring back the same “drill, baby, drill” oil and gas agenda that characterized his first term in office.

But that term began 8 long years ago and much has changed in the domestic oil business since then. Current market realities are likely to mitigate the industry’s response to Trump’s easing of the Biden administration’s efforts to restrict its activities.

Trump’s second term begins as the upstream segment of the industry has enjoyed three years of strong profitability and overall production growth by employing a strategy of capital discipline, technology deployment and the capture of economies of scale in the nation’s big shale play areas. Companies like, say, ExxonMobil and Oxy and their peers are unlikely to respond to the easing of government regulations by discarding these strategies that have brought such financial success in favor of moving into a new drilling boom.

This bias in favor of maintenance of the status quo is especially likely given that the big shale plays in the Permian Basin, Eagle Ford Shale, Bakken Shale, Haynesville and the Marcellus/Utica region have all advanced into the long-term development phases of the natural life cycle typical of every oil and gas resource play over the past 175 years. Absent the discovery of major new shale or other types of oil-or-natural gas-bearing formations, a new drilling boom seems quite unlikely under any circumstances.

One market factor that could result in a somewhat higher active rig count would be a sudden rise in crude oil prices, if it appears likely to last for a long period of time. Companies like Exxon, Chevron, Oxy and Diamondback Energy certainly have the capability to quickly activate a significant number of additional rigs to take advantage of long-term higher prices.

But crude prices are set on a global market, and that market has appeared over-supplied in recent months with little reason to believe the supply/demand equation will change significantly in the near future. Indeed, the OPEC+ cartel has been forced to postpone planned production increases several times over the past 12 months as an over-supplied market has caused prices to hover well below the group’s target price.

But it is wrong to think the domestic oil industry will not respond in any way to Trump’s efforts to remove Biden’s artificial roadblocks to energy progress. Trump’s efforts to speed up permitting for energy projects of all kinds are likely to result in a significant build-out of much-needed new natural gas pipeline capacity, natural gas power generation plants and new LNG export terminals and supporting infrastructure.

Instead of another four years of “drill, baby, drill,” the Trump efforts to speed energy development seem certain to result in four years of a “build, baby, build” boom.

Indeed, the industry is already responding in a big way in the LNG export sector of the business. During Trump’s first week in office, LNG exporter Venture Global launched what is the largest energy IPO by value in U.S. history, going public with a total market cap of $65 billion.

With five separate export projects currently in various stages of development, all in South Louisiana, Venture Global plans to become a major player in one of America’s major growth industries in the coming years. Trump’s Day 1 reversal of Biden’s senseless permitting pause on LNG infrastructure is likely to kick of a number of additional LNG projects by other operators.

The Trump effect took hold even before he took office when the Alaska Gasline Development Corporation entered into an exclusive agreement in early January with developer Glenfarne to advance the $44 billion Alaska LNG project. The aim is to start to deliver gas in 2031, with LNG exports following shortly thereafter.

America’s oil and gas industry has demonstrated it can consistently grow overall production to new records even with a falling rig count in recent years. Now it must grow its related infrastructure to account for the rising production.

That’s why Trump’s “drill, baby, drill” mantra is likely to transform into “build, baby, build” in the months and years to come.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

The ESG Shell Game Behind The U.S. Plastics Pact

From the Daily Caller News Foundation

By Jack McPherrin and H. Sterling Burnett

In recent years, corporate coalitions have increasingly taken center stage in environmental policymaking, often through public-private partnerships aligned with environmental, social, and governance (ESG) goals that promise systemic change.

One of the most prominent examples is the U.S. Plastics Pact (USPP). At first glance, the USPP may appear to some as a promising solution for reducing plastic pollution. But in practice, it has encouraged companies to make changes that are more cosmetic than environmental—and in some cases, actively counterproductive—while increasing their control over the market.

The USPP, launched in 2020, consists of more than 850 companies, non-profits, research institutions, government agencies, and other entities working together to create a new “circular economy for plastics.” Dozens of major retailers and consumer goods companies—including Coca-Cola, Danone, Kraft Heinz, Target, and Unilever—have signed on as “Activators,” pledging to eliminate certain plastics, shift to recyclable packaging, and increase the use of recycled plastics.

Yet, rather than curbing plastic production or reducing waste, the USPP has led many companies to simply transition from polystyrene to polyethylene terephthalate (PET). This shift has been encouraged by claims that PET is more widely recyclable, easier to sort, and better aligned with existing U.S. recycling infrastructure.

However, polystyrene is more moldable, is recyclable, and has insulation properties that PET doesn’t. In addition, PET is approximately 30 percent heavier than polystyrene, meaning more material is required for the same functional use. Moreover, PET requires more energy and is more expensive to produce than polystyrene. And PET’s denser packaging increases transportation-related greenhouse gas emissions and raises costs even more—though these higher costs don’t bother USPP participants, as they simply pass them on to consumers.

Only 5 to 6 percent of all plastics in the United States are recycled. Even for PET products, the overall recycling rate remains low. Just one-third of PET bottles are recycled, while the recycling rate for many other PET products such as thermoforms is less than 10 percent. Most PET products end up in landfills.

This ineffective, costly, and counterproductive shift was not accidental. It reflects the broader incentives baked into ESG scoring systems that reward superficial compliance over substantive outcomes.

ESG frameworks reward companies financially and reputationally for achieving certain narrow targets such as reductions in single-use plastics or increases in the use of packaging that is technically recyclable. However, these metrics often fail to accurately assess total plastic use in a product’s lifecycle, associated emissions, and real-world recovery. A package that uses more plastic and energy—and therefore generates more emissions—may still earn high sustainability marks, so long as the plastic is recyclable in theory. This is a textbook example of greenwashing.

A closer look at the USPP reveals that some of the world’s top plastic users and producers—Coca-Cola, PepsiCo, and Nestlé—are among the Pact’s strongest backers. These corporations, which produce billions of PET containers per year, benefit substantially from signing onto agreements such as the USPP, adopting ESG standards, and pledging support for various green goals—even if they do not deliver any green results. In fact, a 2022 report found that a large majority of retail signatories to the USPP actually increased their consumption of virgin plastic from 2020 to 2021.

Many of these same companies fund the non-profit that organized the USPP: the Ellen MacArthur Foundation. This creates a feedback loop in which large companies shape sustainability standards to their own advantage, defining which materials are “acceptable,” reaping the rewards of ESG compliance, and marginalizing smaller firms that lack the resources to adapt.

For example, by promoting PET as the preferred packaging material, the USPP conveniently reinforces the existing supply chains of these multinational bottlers, while sidelining other materials such as polystyrene that may be more cost-efficient and suitable for specific applications. Smaller manufacturers, who can’t easily switch packaging or absorb the added costs, are effectively squeezed out of the marketplace.

The USPP has not built a circular economy. Rather, it has constructed a closed circle of corporate sponsors that gain reputational boosts and higher ESG scores on the backs of consumers, despite increasing energy and plastics use.

The USPP unites ESG financiers, government agencies, nonprofits, and the largest corporate polluters in a mutually beneficial arrangement. This system rewards compliance, deflects scrutiny, manipulates public trust, eliminates free-market competition, stifles innovation, and increases costs to consumers—all while creating more waste.

Policymakers and consumers alike must recognize that ESG-aligned coalitions such as the U.S. Plastics Pact are nothing more than corporate lobbying groups disguised as sustainability initiatives. They do not improve environmental quality, but they do profit immensely from the illusion of doing so.

Jack McPherrin ([email protected]) is a Research Fellow for the Glenn C. Haskins Emerging Issues Center and H. Sterling Burnett, Ph.D., ([email protected]) is the Director of the Arthur B. Robinson Center on Climate and Environmental Policy, both at The Heartland Institute, a non-partisan, non-profit research organization based in Arlington Heights, Illinois.

Daily Caller

Misguided Climate Policies Create ‘Real Energy Emergency’ And Permit China To Dominate US

From the Daily Caller News Foundation

By Mariane Angela

Interior Secretary Doug Burgum warned on Fox Business Tuesday about America’s deepening energy shortfall and said that misguided climate policies could give China the upper hand in both the global energy race and artificial intelligence development.

House lawmakers voted 246-164, with support from 35 Democrats, to overturn a Biden-era EPA rule that lets California enforce a de facto national ban on gas-powered cars by 2035. During an appearance on “Kudlow,” Burgum said that U.S. energy shortfalls could allow China to outpace America in artificial intelligence and other power-hungry technologies.

“The real energy emergency that we have right now is that we don’t have enough energy in this country. We’re losing the AI arms race to China, and we’ve got to have more energy and more power right now in the country. And so that’s one of the things that we’re focused on right now,” Burgum told host Larry Kudlow.

Burgum blasted California’s aggressive emissions standards, which he said have effectively become national policy.

WATCH:

“Let’s start with California, Larry. That would be a great idea, because there’s 14 other states that followed California. So basically we’re stuck right now. Automakers feel like they’ve got to build two kinds of cars in America, one for California standards and one for the rest of the country,” Burgum said. “Of course, we know that the California standards are based on a bunch of falsehoods around emissions, because if we want zero carbon fuels, it’s much cheaper.”

Burgum took particular aim at electric vehicle subsidies, calling them a boondoggle built on climate ideology. He also called electric vehicle subsidies economically reckless since the cost of avoiding a single ton of carbon dioxide exceeds $900.

“It’s 10 to 15 times cheaper to have zero carbon liquid fuels than it is to subsidize EVs. The EV subsidies, where the real bank was, the thing that was really breaking the bank, over $900 for an avoided tonus of CO2, and all of that built around climate ideology,” Burgum said.

Republican Pennsylvania Rep. John Joyce introduced a resolution under the Congressional Review Act to stop California’s zero-emission vehicle mandate, which several other states have adopted. If the Senate doesn’t act, the Environmental Protection Agency would face a lengthy rulemaking process to reverse the policy that will allow California’s stricter standards to remain in effect for years.

The states that have opted in to California’s auto rules include Colorado, Delaware, Maryland, Massachusetts, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Washington, and the District of Columbia.

-

Alberta2 days ago

Alberta2 days agoPremier Smith seeks Alberta Accord: Announces new relationship with Ottawa

-

Energy2 days ago

Energy2 days agoIt’s time to get excited about the great Canadian LNG opportunity

-

Crime2 days ago

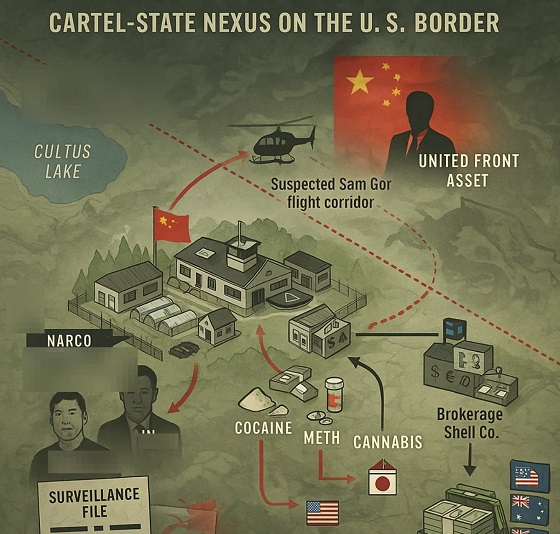

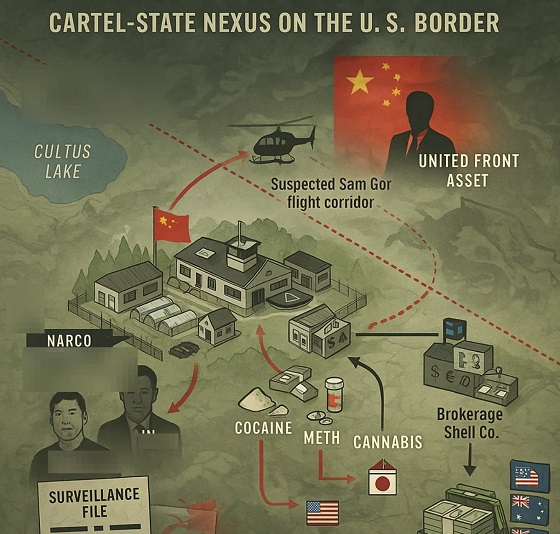

Crime2 days agoInside B.C.’s Cultus Lake Narco Corridor — How Chinese State-Linked Syndicates are Building a Narco Empire in Canada

-

International2 days ago

International2 days agoIce Surprises – Arctic and Antarctic Ice Sheets Are Stabilizing and Growing

-

Energy2 days ago

Energy2 days agoIs the Carney Government Prepared to Negotiate a Fair Deal for the Oil, Gas and Pipeline Sectors

-

Alberta2 days ago

Alberta2 days agoEnergy projects occupy less than three per cent of Alberta’s oil sands region, report says

-

Daily Caller2 days ago

Daily Caller2 days agoMisguided Climate Policies Create ‘Real Energy Emergency’ And Permit China To Dominate US

-

Energy2 days ago

Energy2 days agoOil tankers in Vancouver are loading plenty, but they can load even more