Alberta

Alberta Premier Danielle Smith promises bill protecting rights to refuse vaccines is coming

From LifeSiteNews

The plan is to introduce an amended Bill of Rights this fall that includes protections for individuals’ personal medical decisions.

Alberta Premier Danielle Smith has promised that the province’s Bill of Rights will be amended this fall so that there are protections added for people’s personal medical decisions that most likely will include one having the right to refuse a vaccine.

Smith’s promise to add protections for personal choice on vaccinations comes because of the COVID jab mandates put in place for a time in Alberta under former Premier Jason Kenney.

Speaking to Albertans at a recent town hall in Bonnyville, Smith said that the COVID crisis resulted in many people being discriminated against for their own medical decisions and that “it shouldn’t have happened.”

Smith, who leads the United Conservative Party (UCP), said that she believes “every person has to be able to do their own assessment, their own health assessment, to be able to make those decisions.”

The original plan by Smith was to add protections for one’s vaccine status directly Alberta Human Rights Act (AHRA). However, this plan was nixed after she was advised by Public Health Emergencies Governance Review Panel chair Preston Manning that this was not the right legislation for an additional protection.

Instead, Smith promised that a better “law” dealing directly with vaccine status will be forthcoming.

On Monday, Smith confirmed on X that an updated version of the Bill of Rights is coming.

“It’s time. Let’s get this done,” she wrote.

Last year, Smith, as reported by LifeSiteNews, promised to enshrine into “law” protections for people in her province who choose not to be vaccinated as well as strengthen gun rights and safeguard free speech by beefing up the provincial Bill of Rights.

“You have my commitment, no one’s going to be forced to be vaccinated,” Smith told Alberta blogger Shaun Newman.

On Smith’s first day on the job and only minutes after being sworn in, she said that during the COVID years the “unvaccinated” were the “most discriminated against” group of people in her lifetime.

She took over from Kenney as leader of the UCP on October 11, 2022, after winning the party leadership. The UCP then won a general election in May 2023. Kenney was ousted due to low approval ratings and for reneging on promises not to lock Alberta down during COVID.

Smith promptly fired the province’s top doctor, Deena Hinshaw, and the entire Alberta Health Services board of directors, all of whom oversaw the implementation of COVID mandates.

Under Kenney, thousands of nurses, doctors, and other healthcare and government workers lost their jobs for choosing to not get the jabs.

While Smith has not said much regarding the COVID shots since taking office, she has allowed her caucus members to have broad views when it comes to known safety issues related to the jabs.

UCP MLA Eric Bouchard hosted a sold-out event titled “An Injection of Truth” that featured prominent doctors and experts speaking out against COVID vaccines and mandates.

“Injection of Truth” included well-known speakers critical of COVID mandates and the shots, including Dr. Byram Bridle, Dr. William Makis, canceled doctor Mark Trozzi and pediatric neurologist Eric Payne.

The COVID shots were heavily promoted by the federal government and all provincial governments in Canada, with the Alberta government under Kenney being no exception.

The mRNA shots have been linked to a multitude of negative and often severe side effects in children.

Alberta

Alberta’s oil bankrolls Canada’s public services

This article supplied by Troy Media.

By Perry Kinkaide and Bill Jones

By Perry Kinkaide and Bill Jones

It’s time Canadians admitted Alberta’s oilpatch pays the bills. Other provinces just cash the cheques

When Canadians grumble about Alberta’s energy ambitions—labelling the province greedy for wanting to pump more oil—few stop to ask how much

money from each barrel ends up owing to them?

The irony is staggering. The very provinces rallying for green purity are cashing cheques underwritten not just by Alberta, but indirectly by the United States, which purchases more than 95 per cent of Alberta’s oil and gas, paid in U.S. dollars.

That revenue doesn’t stop at the Rockies. It flows straight to Ottawa, funding equalization programs (which redistribute federal tax revenue to help less wealthy provinces), national infrastructure and federal services that benefit the rest of the country.

This isn’t political rhetoric. It’s economic fact. Before the Leduc oil discovery in 1947, Alberta received about $3 to $5 billion (in today’s dollars) in federal support. Since then, it has paid back more than $500 billion. A $5-billion investment that returned 100 times more is the kind of deal that would send Bay Street into a frenzy.

Alberta’s oilpatch includes a massive industry of energy companies, refineries and pipeline networks that produce and export oil and gas, mostly to the U.S. Each barrel of oil generates roughly $14 in federal revenue through corporate taxes, personal income taxes, GST and additional fiscal capacity that boosts equalization transfers. Multiply that by more than 3.7 million barrels of oil (plus 8.6 billion cubic feet of natural gas) exported daily, and it’s clear Alberta underwrites much of the country’s prosperity.

Yet many Canadians seem unwilling to acknowledge where their prosperity comes from. There’s a growing disconnect between how goods are consumed and how they’re produced. People forget that gasoline comes from oil wells, electricity from power plants and phones from mining. Urban slogans like “Ban Fossil Fuels” rarely engage with the infrastructure and fiscal reality that keeps the country running.

Take Prince Edward Island, for example. From 1957 to 2023, it received $19.8 billion in equalization payments and contributed just $2 billion in taxes—a net gain of $17.8 billion.

Quebec tells a similar story. In 2023 alone, it received more than $14 billion in equalization payments, while continuing to run balanced or surplus budgets. From 1961 to 2023, Quebec received more than $200 billion in equalization payments, much of it funded by revenue from Alberta’s oil industry..

To be clear, not all federal transfers are equalization. Provinces also receive funding through national programs such as the Canada Health Transfer and

Canada Social Transfer. But equalization is the one most directly tied to the relative strength of provincial economies, and Alberta’s wealth has long driven that system.

By contrast to the have-not provinces, Alberta’s contribution has been extraordinary—an estimated 11.6 per cent annualized return on the federal

support it once received. Each Canadian receives about $485 per year from Alberta-generated oil revenues alone. Alberta is not the problem—it’s the

foundation of a prosperous Canada.

Still, when Alberta questions equalization or federal energy policy, critics cry foul. Premier Danielle Smith is not wrong to challenge a system in which the province footing the bill is the one most often criticized.

Yes, the oilpatch has flaws. Climate change is real. And many oil profits flow to shareholders abroad. But dismantling Alberta’s oil industry tomorrow wouldn’t stop climate change—it would only unravel the fiscal framework that sustains Canada.

The future must balance ambition with reality. Cleaner energy is essential, but not at the expense of biting the hand that feeds us.

And here’s the kicker: Donald Trump has long claimed the U.S. doesn’t need Canada’s products and therefore subsidizes Canada. Many Canadians scoffed.

But look at the flow of U.S. dollars into Alberta’s oilpatch—dollars that then bankroll Canada’s federal budget—and maybe, for once, he has a point.

It’s time to stop denying where Canada’s wealth comes from. Alberta isn’t the problem. It’s central to the country’s prosperity and unity.

Dr. Perry Kinkaide is a visionary leader and change agent. Since retiring in 2001, he has served as an advisor and director for various organizations and founded the Alberta Council of Technologies Society in 2005. Previously, he held leadership roles at KPMG Consulting and the Alberta Government. He holds a BA from Colgate University and an MSc and PhD in Brain Research from the University of Alberta.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

Alberta’s industrial carbon tax freeze is a good first step

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation is applauding Alberta Premier Danielle Smith’s decision to freeze the province’s industrial carbon tax.

“Smith is right to freeze the cost of Alberta’s hidden industrial carbon tax that increases the cost of everything,” said Gage Haubrich, CTF Prairie Director. “This move is a no-brainer to make Alberta more competitive, save taxpayers money and protect jobs.”

Smith announced the Alberta government will be freezing the rate of its industrial carbon tax at $95 per tonne.

The federal government set the rate of the consumer carbon tax to zero on April 1. However, it still imposes a requirement for an industrial carbon tax.

Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax.

The industrial carbon tax currently costs businesses $95 per tonne of emissions. It is set to increase to $170 per tonne by 2030. Carney has said he would extend the current industrial carbon tax framework until 2035, meaning the costs could reach $245 a tonne. That’s more than double the current tax.

The Saskatchewan government recently scrapped its industrial carbon tax completely.

Seventy per cent of Canadians said businesses pass most or some industrial carbon tax costs on to consumers, according to a recent Leger poll.

“Smith needs to stand up for Albertans and cancel the industrial carbon tax altogether,” Haubrich said. “Smith deserves credit for freezing Alberta’s industrial carbon tax and she needs to finish the job by scrapping the industrial carbon tax completely.”

-

Alberta1 day ago

Alberta1 day agoPremier Smith seeks Alberta Accord: Announces new relationship with Ottawa

-

Energy1 day ago

Energy1 day agoIt’s time to get excited about the great Canadian LNG opportunity

-

International1 day ago

International1 day agoIce Surprises – Arctic and Antarctic Ice Sheets Are Stabilizing and Growing

-

Crime1 day ago

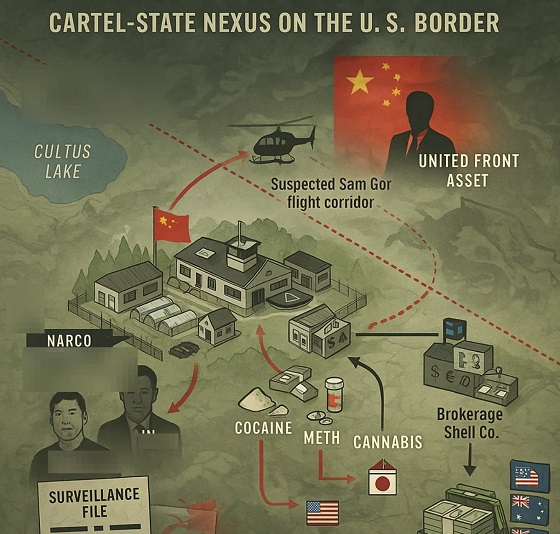

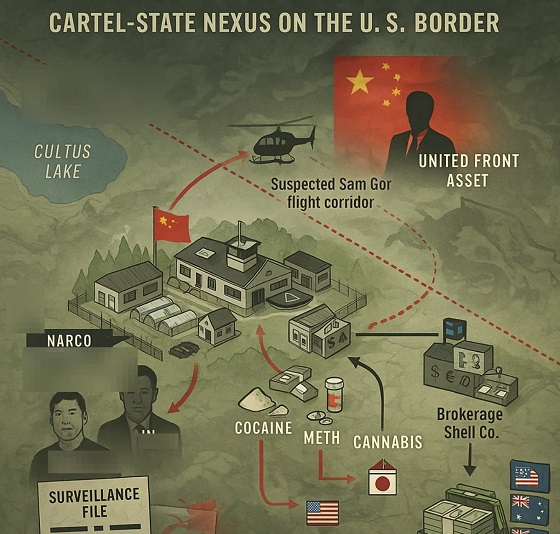

Crime1 day agoInside B.C.’s Cultus Lake Narco Corridor — How Chinese State-Linked Syndicates are Building a Narco Empire in Canada

-

Energy1 day ago

Energy1 day agoIs the Carney Government Prepared to Negotiate a Fair Deal for the Oil, Gas and Pipeline Sectors

-

Alberta1 day ago

Alberta1 day agoEnergy projects occupy less than three per cent of Alberta’s oil sands region, report says

-

Health1 day ago

Health1 day agoJay Bhattacharya Closes NIH’s Last Beagle Lab

-

Business1 day ago

Business1 day agoWelcome to Elon Musk’s New Company Town: ‘Starbase, TX’ Votes To Incorporate