Business

Behind the latest CPI Numbers: Inflation Slows, But Living Costs Don’t

Behind the 1.7% headline, falling gas prices mask deeper affordability issues—from rising rents and mortgage costs to inflated essentials still burdening working Canadians.

Canada’s latest Consumer Price Index (CPI) report dropped this week, and if you believe the headlines, things are looking up. The Trudeau government is gone, Mark Carney is in charge, and the narrative from the media-industrial complex is that inflation is under control. The truth, however, is far more complicated—and much uglier.

Let’s break it down.

The Good

Let’s start with the headline everyone’s pretending is a victory: inflation is at 1.7%. That’s the lowest in recent memory. Great, right? Well, before we throw a parade for Mark Carney and the ghost of Justin Trudeau, let’s be honest about why that number dropped.

It’s because they killed the carbon tax. That’s it. The federal consumer carbon levy—gone as of April 1st—took a sledgehammer to gasoline prices. Down 15.5% year-over-year. That’s not Liberal brilliance; that’s what happens when you stop punishing working people for heating their homes and driving to their jobs. It’s the most obvious economic lesson in the world—and it took a political collapse to learn it.

And sure, some other costs went down too. Airfare, travel tours, natural gas—all dipping. But let’s be honest here: how many average Canadians are flying to tropical resorts right now? Those declines are meaningless unless you’re upper-middle class or live in a city with piped-in gas. For most people, this isn’t relief—it’s background noise.

So yes, things look “better” on paper. But that’s only because Ottawa stopped making them actively worse. Don’t confuse less harm with actual help.

The Bad

Now, if you strip away the smoke and mirrors—take out gas and energy, the very components that dropped because the Liberals stopped interfering—you’ll find core inflation is still sitting at 2.7%. That’s above the Bank of Canada’s target. So while they’re bragging about a “cooling economy,” everything that actually matters to working people is still getting more expensive.

Start with rent—up 4.5% nationwide. And in Ontario, where they’re spinning it as a “slowdown,” it’s still climbing at 3%. Let’s be blunt: this is the Trudeau housing crisis in full bloom. Years of unchecked immigration, foreign investment, and anti-building regulations have created a market where young Canadians can’t dream of buying, and now can’t even afford to rent. This isn’t stability—it’s metastasis.

And then there’s food. Up 3.4% year-over-year. That’s every single trip to the grocery store hitting harder. Why? Because for years, this government pumped the economy full of cheap cash, shut down critical supply chains, and slapped on regulation after regulation—then acted shocked when bread and eggs cost more than your phone bill.

So no, the bad news didn’t disappear. It’s just buried under a layer of statistical gaslighting.

The Ugly

This is where the mask really slips.

Let’s start with mortgage interest—up 6.2% year-over-year. That’s the 21st consecutive month of rising costs for homeowners. Why? Because the Carney–Trudeau economic cartel raised rates into the stratosphere to fix the very inflation they helped ignite. Now the middle class is getting crushed under monthly payments they can’t afford, and the Liberal elite shrugs, sipping Chardonnay in their fully paid-off Ottawa brownstones.

But it doesn’t stop there.

Telephone services shot up 7.2% in just one month. Remember when Trudeau promised affordable internet and more competition in telecom? Yeah—didn’t happen. Instead, we’ve got an oligopoly of pampered monopolies bleeding Canadians dry, with zero consequences. They feast, you pay. That’s the Liberal model.

And then there’s the EV scam—the real gem of elite technocracy. New car prices are up 4.9%, driven mostly by electric vehicles. Why? Because the government is subsidizing them with your tax dollars while simultaneously making it harder and more expensive to buy a gas-powered car. They call it “green policy”—you call it unaffordable transportation.

This isn’t economic policy. It’s social engineering through price pain. And it’s working—just not for you.

Final Thoughts

So here’s where we are: inflation is down—but not because of any real reform. It’s down because the Liberals were forced, kicking and screaming, to repeal a tax that never should’ve existed. Meanwhile, the real cost of living continues to grind down working Canadians, and the architects of this disaster are still in power—just with a different name on the door.

Mark Carney, Trudeau’s former banker-in-chief, is now the frontman for the same agenda: globalist economics, central planning, and performative concern for affordability—all while mortgage costs rise, rent stays unaffordable, and you get nickeled and dimed on everything from food to phone bills.

They’ll tell you this is progress. It’s not. It’s a managed decline, and the only reason it’s slowing is because the wrecking crew paused long enough to read the polls.

Don’t be fooled by the numbers. This is what it looks like when a political class tries to walk back years of economic sabotage without ever admitting fault. They won’t stop unless you make them.

Until then, this isn’t a recovery—it’s a recalibration of how much you’re allowed to lose. And the people who built the system want you to be grateful for it.

Business

Why it’s time to repeal the oil tanker ban on B.C.’s north coast

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

By Will Gibson

Moratorium does little to improve marine safety while sending the wrong message to energy investors

In 2019, Martha Hall Findlay, then-CEO of the Canada West Foundation, penned a strongly worded op-ed in the Globe and Mail calling the federal ban of oil tankers on B.C.’s northern coast “un-Canadian.”

Six years later, her opinion hasn’t changed.

“It was bad legislation and the government should get rid of it,” said Hall Findlay, now director of the University of Calgary’s School of Public Policy.

The moratorium, known as Bill C-48, banned vessels carrying more than 12,500 tonnes of oil from accessing northern B.C. ports.

Targeting products from one sector in one area does little to achieve the goal of overall improved marine transport safety, she said.

“There are risks associated with any kind of transportation with any goods, and not all of them are with oil tankers. All that singling out one part of one coast did was prevent more oil and gas from being produced that could be shipped off that coast,” she said.

Hall Findlay is a former Liberal MP who served as Suncor Energy’s chief sustainability officer before taking on her role at the University of Calgary.

She sees an opportunity to remove the tanker moratorium in light of changing attitudes about resource development across Canada and a new federal government that has publicly committed to delivering nation-building energy projects.

“There’s a greater recognition in large portions of the public across the country, not just Alberta and Saskatchewan, that Canada is too dependent on the United States as the only customer for our energy products,” she said.

“There are better alternatives to C-48, such as setting aside what are called Particularly Sensitive Sea Areas, which have been established in areas such as the Great Barrier Reef and the Galapagos Islands.”

The Business Council of British Columbia, which represents more than 200 companies, post-secondary institutions and industry associations, echoes Hall Findlay’s call for the tanker ban to be repealed.

“Comparable shipments face no such restrictions on the East Coast,” said Denise Mullen, the council’s director of environment, sustainability and Indigenous relations.

“This unfair treatment reinforces Canada’s over-reliance on the U.S. market, where Canadian oil is sold at a discount, by restricting access to Asia-Pacific markets.

“This results in billions in lost government revenues and reduced private investment at a time when our economy can least afford it.”

The ban on tanker traffic specifically in northern B.C. doesn’t make sense given Canada already has strong marine safety regulations in place, Mullen said.

Notably, completion of the Trans Mountain Pipeline expansion in 2024 also doubled marine spill response capacity on Canada’s West Coast. A $170 million investment added new equipment, personnel and response bases in the Salish Sea.

“The [C-48] moratorium adds little real protection while sending a damaging message to global investors,” she said.

“This undermines the confidence needed for long-term investment in critical trade-enabling infrastructure.”

Indigenous Resource Network executive director John Desjarlais senses there’s an openness to revisiting the issue for Indigenous communities.

“Sentiment has changed and evolved in the past six years,” he said.

“There are still concerns and trust that needs to be built. But there’s also a recognition that in addition to environmental impacts, [there are] consequences of not doing it in terms of an economic impact as well as the cascading socio-economic impacts.”

The ban effectively killed the proposed $16-billion Eagle Spirit project, an Indigenous-led pipeline that would have shipped oil from northern Alberta to a tidewater export terminal at Prince Rupert, B.C.

“When you have Indigenous participants who want to advance these projects, the moratorium needs to be revisited,” Desjarlais said.

He notes that in the six years since the tanker ban went into effect, there are growing partnerships between B.C. First Nations and the energy industry, including the Haisla Nation’s Cedar LNG project and the Nisga’a Nation’s Ksi Lisims LNG project.

This has deepened the trust that projects can mitigate risks while providing economic reconciliation and benefits to communities, Dejarlais said.

“Industry has come leaps and bounds in terms of working with First Nations,” he said.

“They are treating the rights of the communities they work with appropriately in terms of project risk and returns.”

Hall Findlay is cautiously optimistic that the tanker ban will be replaced by more appropriate legislation.

“I’m hoping that we see the revival of a federal government that brings pragmatism to governing the country,” she said.

“Repealing C-48 would be a sign of that happening.”

Business

Latest shakedown attempt by Canada Post underscores need for privatization

From the Fraser Institute

By Alex Whalen and Jake Fuss

For the second time in just six months, the Canadian Union of Postal Workers (CUPW) is threatening strike action. As Canadians know all too well, postal strikes can be highly disruptive given the federal government provides Canada Post with a near-monopoly on letter mail across the country. CUPW is well aware of this and uses it to their advantage in negotiations. While CUPW has the right to ask for whatever they like, Canadians should finally be freed from this albatross.

In January, the Trudeau government loaned Canada Post a whopping $1.034 billion to help “maintain its solvency and continue operating.” Since 2018, Canada Post has lost more than $4.6 billion, and according to its latest financial update, lost more than $100 million in the first quarter of 2025 alone. Canadians are on the hook for these losses because the federal government owns Canada Post.

Salaries and other employee costs comprise more than 66 per cent of Canada Post’s expenses, and CUPW and Canada Post management both know they can simply pass any losses on to Canadians. Consequently, there’s less incentive for management to control the bottom line or make reasonable budget requests when negotiating with the government. But if the government privatizes Canada Post, it would impose a proper constraint on costs that doesn’t currently exist. This is only fair given there’s no compelling reason why Canadians should underwrite the inflation of salaries in a money-losing Crown corporation.

Of course, government ownership of Canada Post is archaic. When the organization was founded more than 250 years ago, the world was quite different. In today’s age of Amazon, a plethora of delivery services exist coast-to-coast that serve Canadian consumers. Other countries including the Netherlands, Austria and Germany long ago privatized their postal services. The result was increased competition, which in turn reduced prices and improved quality.

Alongside privatization, the federal government should also eliminate Canada Post’s near-monopoly status on letter mail. This policy is purportedly meant to ensure universal service. But in reality, it prohibits other potential service providers from entering the letter-delivery market (including in remote areas that may experience less Canada Post service post-privatization), deprives Canadians of choice, and crucially, reduces the incentive for Canada Post to improve its service.

Simply put, the federal government should focus on its core responsibilities, and delivering mail is clearly not one of them. Given Canada Post’s latest attempted shakedown of Canadians, it’s never been clearer that it’s time for Canada Post to go the way of Air Canada, de Havilland and CN Rail. Once upon a time, the federal government owned all three of these entities until it became clear there was no reason for the government to own an airline, build planes or deliver goods by train. Why is letter mail any different? Canadians deserve better.

-

COVID-191 day ago

COVID-191 day agoNew Peer-Reviewed Study Affirms COVID Vaccines Reduce Fertility

-

Business24 hours ago

Business24 hours agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

Alberta2 days ago

Alberta2 days agoAlberta Next Takes A Look At Alberta Provincial Police Force

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Alberta1 day ago

Alberta1 day agoThe permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

-

Alberta23 hours ago

Alberta23 hours agoAlberta’s government is investing $5 million to help launch the world’s first direct air capture centre at Innisfail

-

Business21 hours ago

Business21 hours agoWorld Economic Forum Aims to Repair Relations with Schwab

-

Business1 day ago

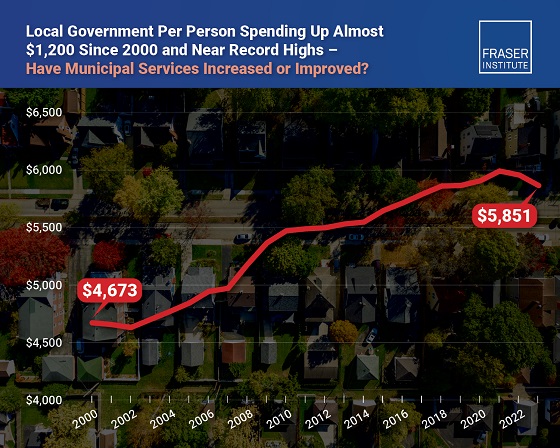

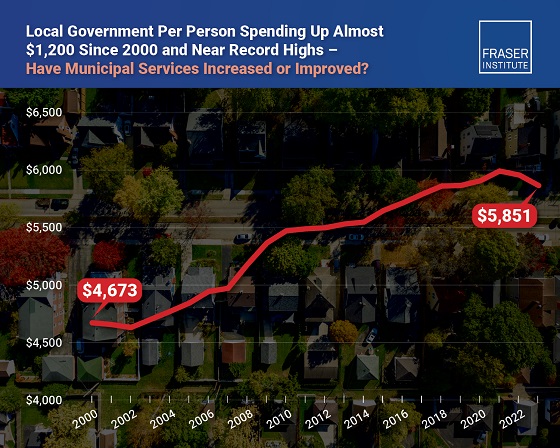

Business1 day agoMunicipal government per-person spending in Canada hit near record levels