Energy

Canada’s Most Impactful Energy Issues in 2024

From EnergyNow.ca

By Deidra Garyk

It feels like we are in the beginning of a cultural, social, and political disruption. The fear of saying the wrong thing and being cancelled is subsiding, resulting in robust debate about important topics. Public pushback against climate alarmism and energy misinformation is getting louder as more and more people join in the discussion.

I have enjoyed watching the increased skepticism and distrust towards “the settled Science” and the agreed upon narratives in favour of open, genuine, inquisitive conversations with a focus on practicable solutions. People are fed up with niche topics taking up a disproportionate amount of airtime in place of issues that are relevant to the majority of the country.

These are a few of the energy topics that I feel were most impactful for the year, with many having a lasting impact into 2025 and beyond.

SHIFTING POLITICAL WINDS

As Canada implements more and more regulatory hurdles for the oil and gas industry, the US re-elected pro-business, pro-oil, political outsider Donald Trump in a ‘uge win, with the majority of counties shifting from blue (Democrat) to red (Republican).

He isn’t even sworn in, and Trump is lighting things up via social media decrees. Using Truth Social, he announced that a 25 percent tariff will be placed on all goods coming from Canada and Mexico unless their respective borders are addressed to his satisfaction.

This will affect all Canadian businesses, not the least being those in the oil patch since 4 million barrels of oil per day go to the US, along with 7.9 billion cubic feet per day of natural gas. 77 percent of Canadian exports enter the US market; therefore, a 25 percent tariff is another obstacle affecting Canadian businesses’ competitiveness, which are already faced with various regulatory and taxation hurdles from Canadian governments, such as the carbon tax that increases each year.

Expect to see a shake-up in the Department of Energy and the narrative around climate and energy with the nomination of Chris Wright, CEO of Liberty Energy, for US Secretary of Energy. Chris has been a bold, unapologetic, pragmatic energy realist who cares about balancing environmental responsibility with resource development to help supply the world with reliable, affordable energy. His principled leadership has elevated him to one of the highest offices in the US.

Chris Wright is not afraid to go against the crowd. Liberty successfully challenged the SEC’s climate reporting rules and were instrumental in getting them halted. You can listen to his clarity of thought as he testifies on the rules before the U.S. House of Representatives’ Financial Services Committee (Chris’ testimony starts at 53:58).

As the first energy secretary to come from the energy sector, I anticipate that the government’s energy messaging and policy is going to shift away from climate alarmism to one of balance and open-mindedness. I hope he staffs the Department with people who understand energy and are not focused on misguided ideology. The ripple effects will be felt around the globe, and now is the time to embrace people’s scepticism and exhaustion with the constant drumbeat of fear about the use of hydrocarbons.

Much like the massive political shift voted in by the Americans, Canadians are also ready for a change. Prime Minister Trudeau and his Liberal party continue to lag in the polls, indicating voters’ displeasure with their policies. Poll aggregator 338Canada predicts a resounding majority for the federal Conservatives. Will we begin to see better energy policy after the next election?

RENEWABLES’ REALITY AND COOLING CLIMATE CLUBS

As a further demonstration of the shifting social and political winds, the net zero climate movement has seen major companies quell their public support for associated initiatives. The appetite for costly net zero commitments from voters who are struggling to pay their bills is waning, and politicians are hearing about it.

Many Republican-led states have pushed back on anti-hydrocarbon, net zero financing, and that has influenced how companies behave, starting with an exodus from Mark Carney’s net zero alliance, GFANZ (Glasgow Financial Alliance for Net Zero). The Net-Zero Insurance Alliance (NZIA), a subset of GFANZ, has lost about half of its members since March 2023. Climate initiatives, like Climate Action 100+ and the Net Zero Banking Alliance (NZBA) are also losing members who are concerned about the consequences of their affiliation with anti-hydrocarbon groups who attempt to influence how businesses conduct their operations, sometimes through coercive involuntary membership and social shaming.

The energy transition continues to face opposition. In summer 2023, the Alberta government placed a temporary, six-month moratorium on renewable energy – wind and solar – projects in an attempt to balance development with agricultural and social concerns. The condemnation from environmental groups and the Alberta NDP was swift and loud, but not always truthful. On the other side were landowners who were concerned about the consequences of the projects on their communities. A documentary, Generation Green, by filmmaker Heidi McKillop, documents the push-pull of renewable project development in Alberta.

The new rules include development limits on certain agricultural lands, protection of viewscapes using buffer zones, and a requirement for an upfront bond to pay for future reclamation costs. Landowners and associations have praised the changes for addressing concerns and being balanced.

January’s polar vortex reconfirmed people’s willingness to rethink some large-scale industrial wind and solar installations. The extreme cold resulted in alerts warning of potential rotating blackouts, reminding Albertans about the need for reliable, affordable, on-demand energy.

At the same time that Canadians are questioning the reliability of our grids, the government went all in on their bet on the adoption of electric vehicles, generously giving EV battery makers billions of taxpayer-funded subsidies to set up shop in Canada. However, plans have hit speed bumps (pun intended).

Sweden’s Northvolt, the recipient of $7.3 billion in loans, equity stakes, and subsidies from Canada, recently filed for bankruptcy protection in the US. The company says this will not affect its Canadian plant, which is being used as collateral to secure bailout financing in the US. Meanwhile, other plants have been delayed. It seems like this may not have been a good “investment” for taxpayers.

Not that the Liberal government has been cautious with our money. Sustainable Development Technology Canada, colloquially referred to as the green slush fund, violated government funding rules and breached conflict-of-interest and ethics laws by improperly giving away millions of dollars. The scandal is so bad that the RCMP are investigating whether or not there was criminal wrongdoing; however, the government has been at a standstill for weeks because the Liberals refuse to hand over documents to help with the investigation.

COP29, THE FINANCE COP(S)

The COP conflab in Baku, Azerbaijan, in November didn’t skip a beat, seemingly ignorant of the shifting support for costly environmental action predicated on alarmism. Its 65,000 delegates waxed lyrical about the need to transfer funds from developed nations who are allegedly responsible for climate change to developing nations who are disproportionately victimized by changing weather conditions. What was dubbed “the New Collective Quantified Goal” (NCQG) on climate finance, governments tripled their handouts to US$300 billion annually by 2035, and got commits from public and private entities to increase that funding to US$1.3 trillion per year by 2035.

No one likes spending other people’s money quite like Minister Steven Guilbeault. You can find a daily outline of Canada’s COP commitments here.

We should have a new environment minister in time for COP30 in Brazil. And thankfully so, my wallet can’t take much more!

REGULATORY RAT’S NEST

In June, with the passage of Bill C-59, the Canadian Competition Act was amended with expanded provisions to address greenwashing complaints, including excessively punitive charges for breaking the new rules. The gag order has silenced oil and gas companies. Many, such as the Pathways Alliance of the six biggest oilsands producers, took down their websites immediately after the changes were announced. Others took down their ESG reports and environmental statements.

Even though oil and gas is likely to be disproportionately targeted and penalized, this Bill is agnostic; complaints can be made against all industries, and the unelected, unaccountable bureaucracy will decide who will and will not be investigated.

The fines are material. $750,000 for an individual’s first offence and $10 million per misrepresentation for a company’s first offense, up to 3% of annual worldwide gross revenues. Analysis from one of the Big Four consulting firms uncovered approximately one potential misrepresentation per page of an ESG report; some reports run close to 100 pages, so the consequences of a fine are impactful, hence the swift reaction from companies.

While business leaders navigate the landmines created by C-59, mandatory sustainability (i.e. ESG) reporting standards are expected to be rolled out next year, with the latest draft issued in the next week or two. The Canadian securities regulator has said they are focused on climate as the first reporting topic. Nevertheless, it is reasonable to expect the Canadian standards will be expanded as the international standards broaden to include biodiversity and human capital, and possibly “just transition”.

In addition to the requirements for publicly traded companies, the feds’ announced mandatory climate reporting for all large, Canadian incorporated companies, including private. Corporations will be forced to publicly disclose their environmental performance while also being hamstrung by the greenwashing changes.

If you feel like an Olympian high jumper, it may be because companies have to be to meet ever higher regulatory requirements set by our federal government. Just when companies think they’ve cleared the bar by voluntarily cutting emissions from production, the feds raise it one foot higher.

November 4 brought the long-awaited draft emissions cap for the oil and gas industry, targeting a 35 percent emissions reduction below 2019 levels by 2030. To say the industry is annoyed is an understatement, and rightfully so.

You can’t keep a good industry down, though! The Canadian Association of Energy Contractors (CAOEC) is forecasting drilling growth in 2025, meaning the industry and its jobs are maintaining a positive trajectory. There’s continued optimism in the patch thanks to increased egress capacity following the start-up of TMX and the near completion of LNG Canada. The CAOEC 2025 forecast anticipates a total of 6,604 wells drilled, a 5.2% increase in rig operating hours, and total jobs (direct and indirect) of 41,800 – all up from 2024. This is good for workers, families, communities, and the economy.

PIPELINE EGRESS PROGRESS

The long-delayed, over-cost Trans Mountain Expansion Project (TMX) became operational on May 1, 2024, proving that we can still build things in Canada. The pipeline allows for the transportation of up to 890,000 barrels per day of oil to the west coast, which has helped narrow the differential of Western Canada Select crude. Congrats to everyone who worked on the project!

Another project of significant national importance is the 670 kilometre Coastal GasLink (CGL), the first pipeline built to the west coast in 70 years. Although the historical pipeline was completed ahead of schedule in late 2023, its completion affected the drilling and development plans of companies this year as we wait for the start up of the LNG Canada facility in 2025. CGL is another reason for optimism.

PERSONAL HIGHLIGHTS AND MILESTONES

2024 marks 20 years in the patch for me. I’ve had the opportunity to work alongside many astute, industrious, innovative folks who have integrity and heart for their work and co-workers. I thank each of you for shaping my career.

In February, I moderated EnergyNow’s event The Road Ahead: Alberta Energy 2024 with Minister of Energy and Minerals Brian Jean and distinguished energy analyst Dave Yager. We sold out the Petroleum Club ballroom and filled the room with lively discussion and camaraderie.

I then had the honour of moderating the sold-out luncheon panel at the 2024 Lloydminster Heavy Oil Show in September, featuring Alberta Premier Danielle Smith and Saskatchewan Premier Scott Moe. They graciously answered my questions, including one on the Keystone Pipeline – the new “hot topic”.

Premier Smith predicted that a change in US government could see the project resurrected. The Republicans took control of the White House, the Senate, and the House, so we will see if the Premier gets her wish. You can listen to her full answer here and a shorter clip here.

As we close off another fortunate year, I wish all the best for 2025.

Deidra Garyk is the Founder and President of Equipois:ability Advisory, a consulting firm specializing in sustainability solutions. Over 20 years in the Canadian energy sector, Deidra held key roles, where she focused on a broad range of initiatives, from sustainability reporting to fostering collaboration among industry stakeholders through her work in joint venture contracts.

Outside of her professional commitments, Deidra is an energy advocate and a recognized thought leader. She is passionate about promoting balanced, fact-based discussions on energy policy, and sustainability. Through her research, writing, and public speaking, Deidra seeks to advance a more informed and pragmatic dialogue on the future of energy.

Daily Caller

US Energy Secretary Chris Wright Has To Clean Up Joe Biden’s Mess and refill the Strategic Petroleum Reserve

From the Daily Caller News Foundation

By David Blackmon

Joe Biden and his appointees took an abundance of costly and damaging policy actions during his four-year term in office. Fortunately, that damaging agenda was limited to a single term presidency by voters last November who had grown weary of footing the massive bills for it all in the form of constantly increasing prices for all forms of energy.

Now the task of cleaning it all up and repairing the damage falls to President Donald Trump and his appointees. In another fortunate development for America, the President has chosen an eager and extremely talented array of energy-related appointees, including EPA Administrator Lee Zeldin, Interior Secretary Doug Burgum, and Energy Secretary Chris Wright.

One of the costliest actions taken by ex-President Biden related to U.S. national security came when he decided to raid the Strategic Petroleum Reserve by using it as a campaign tool to influence the 2022 mid-term elections. Early that year, Biden invoked a program to rapidly deplete the contents of the SPR, pulling 1 million barrels per day from the underground salt caverns which hold the crude for 180 days in hopes of lowering gas prices at the pump.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

In an interview this week with radio host Glenn Beck, Secretary Wright revealed that, by drawing the volumes down so rapidly, Biden caused damage to the integrity of those salt caverns so severe that his Energy Department will now have to spend a big piece of its budget repairing the infrastructure before the caverns can be refilled. “[Biden] flooded the market with oil, reduced the price of oil in the short term but at the cost of U.S. strategic positioning, and they damaged the facilities in the Strategic petroleum reserve by draining them so fast,” Wright told Beck, adding, “We have to spend over $100 million to repair the damage of the Strategic Petroleum Reserve that wasn’t built for that.”

For readers who may not be aware, Congress and President Gerald Ford authorized the creation of the SPR in 1975 in the wake of the first Arab Oil Embargo of 1973-74 That embargo caused severe shortages of gasoline, along with price spikes across the United States. Congress intended the SPR as a tool whose careful deployment would enhance and protect national security in times of real emergencies, not one to be used for cynical political purposes.

“It’s for when a very bad day happens,” Wright put it to Beck. “The world literally runs on oil. If you don’t have oil, you’re screwed in everything you do – economics, defense, health care, anything.”

In March, Secretary Wright unveiled an aggressive plan to refill the SPR, estimating the cost of doing so at the $70 per barrel price that prevailed at the time to be about $20 billion. He also estimated it would take 4 to 6 years to complete the process due to the magnitude of Biden’s unwise withdrawals. Filling the reserve is not something that can be done all in a single transaction. Rather, it is a complex process governed by regulations which require DOE to solicit competitive bids for relatively small lots of crude.

“By design, it’s much slower to fill it than to drain it,” Wright told Beck. “It will take us, going flat out, four, five, six years to refill the Strategic Petroleum Reserve. We are dead set committed to do it, but we’ve compromised our national security for years to get a little bit of an electoral advantage in 2022.”

It should be noted here that Wright would love to take advantage of current low oil prices, which have dropped to around $60/bbl today. Obviously, the same “buy low, sell high” philosophy followed by smart stock investors applies to buying and selling crude oil, too.

But DOE’s buyback program cannot begin until the damage caused by Biden’s careless disregard for national security has been repaired. Doing that will require months, during which time oil prices could rise or drop significantly.

“Energy is the infrastructure of life,” Wright reminded Beck. “You can’t use it for politics.”

But unfortunately for U.S. national security, Joe Biden did just that. The mess he left behind is Wright’s to clean up.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Energy

It’s time to get excited about the great Canadian LNG opportunity

By Stewart Muir

By Stewart Muir

Canada has a rare window to join the big leagues of LNG exporters—Qatar, Australia, and the United States are not waiting around, and neither should we.

I sometimes catch myself staring out over the waters of British Columbia’s coastline — so calm, so vast, so brimming with unspoken opportunity — and I can’t help but wonder how anyone could fail to notice the promise that Liquefied Natural Gas (LNG) represents for our nation’s future. This country sits atop some of the largest gas reserves on Earth, and we have two coasts eager to connect our product to global markets.

I’m a quietly enthusiastic type by nature, and I don’t often indulge in the “I-told-you-so” routine, but whenever I encounter someone who just hasn’t cottoned on to the excitement around LNG, I feel compelled to stage a gentle intervention.

In my day-to-day role as CEO of Resource Works, I work with communities from Fort St. John to Kitimat, and beyond. Let me assure you, if you want to see Canadians at work, proud of their craft, and eyeing a brighter future, you’ll find them along the pipeline routes and port terminals that are part of our budding LNG industry. And they’re just as commonly found in Vancouver, Victoria and the other cities, just harder to spot with no blue coveralls.

I’ve been following the natural gas story in British Columbia for more than a quarter of a century, going back to my days in the media field. As an editor at The Vancouver Sun, I created the paper’s first-ever energy beat after we noticed something big was stirring in the North East gas fields. It turned out to be an industry animated by regulatory innovation, rich geology, ambitious investors, and some of the most capable people you’ll ever meet.

When talk of LNG exports began to stir in 2011, I dove in with both feet. Over the past 15 years, I’ve followed the LNG file across Canada, around the world, and deep into the heart of British Columbia.

Along the way, I’ve met First Nations chiefs who proudly showed me the schools and businesses they built through new partnerships. I’ve also sat down with those who remain skeptical and had honest, sometimes searching conversations. I’ve learned something from all of them. This is an industry that, at its best, brings people together to solve problems, create opportunity, and build a future worth caring about.

Why am I still so enthused after all these years? LNG is not a flash in the pan, for starters. Through cyclical ups and downs—natural phenomena in any commodity game—international forecasts consistently show that LNG demand won’t be evaporating tomorrow or, quite likely, for several tomorrows yet. The International Energy Agency, the Canada Energy Regulator, and even the U.S. Energy Information Administration all point to steady growth in global LNG trade.

On top of that, if you follow the money, you’ll see billions of dollars flowing into new regasification terminals and record orders for LNG carriers. I may be old-fashioned, but I’ve always found that when so many investors plunk down their capital in one place, it’s seldom a fluke. The world has more than 700 LNG ships plying the seas these days, and hundreds more under construction. That’s not a small bit of confidence.

And let’s talk local: from where I sit, Canada’s jobs outlook tied to LNG looks like a real tonic for communities seeking new opportunities. Construction alone can employ entire regions. Then come the careers that last decades—plant operators, engineers, port and shipping managers, the works. It’s the sort of diversified prosperity that a resource economy yearns for.

We’ve even seen First Nations communities take equity stakes in major LNG projects, forging new partnerships that benefit everyone involved. That’s the model of inclusive economic development that Canadians like to talk about. It’s called walking the walk.

Those voices of skepticism — bless their hearts — sometimes say, “But what about price volatility? The commodity cycles? Are we sure this is sustainable?” Truthfully, no commodity is immune to upswings and downswings. But open a newspaper — digitally or in paper form, your choice— and you’ll find that countries all over the world are expanding their LNG-import infrastructure. Many of them, especially in Asia and Europe, see Canada as a steady, well-regulated, and (importantly) speedy supplier.

Yes, “speedy” might be an odd descriptor for us easygoing Canadians, but let’s not overlook that a West Coast port is only about eight or nine sailing days from major Asian markets, versus more than 20 from the U.S. Gulf Coast. You’d think we’d have lines of ships lined up right now, just for that advantage.

There’s another subtlety that some folks overlook. Right now, much of our gas still flows to the United States, often at discounted prices, only to be converted into LNG down there and sold globally at a premium. If that doesn’t make you shake your head in wonder, I’m not sure what will. Canadians have every reason to want to keep some of that up-chain value right here at home, funneling more of that revenue into local jobs and public coffers. That’s exactly the sort of well-to-customer supply chain we’re poised to build.

And if you’re still not impressed, consider the big jolt to GDP whenever a massive energy project crosses the finish line. Look no further than the Trans Mountain pipeline expansion: once it was substantially complete last year, the national GDP got a measurable jolt. It’s extremely rare that a single anything shows up that way. Now, with the first shipment of Canadian LNG preparing to leave Kitimat in the coming weeks, we can expect a repeat performance. It’s the real economic equivalent of an encore, if you will. And who doesn’t love an encore that boosts paycheques and government revenues?

Canadians may be known worldwide for politeness and hockey, but let’s not forget that boldness is also in our national DNA. Building a robust LNG sector that ties Western and Eastern Canada to major global markets is about as bold an economic strategy as we could pursue right now. Some might call it visionary, others might say it’s just common sense in a world that still demands substantial amounts of energy. Either way, Canada has a rare window to join the big leagues of LNG exporters—Qatar, Australia, and the United States are not waiting around, and neither should we.

At the end of the day, seeing Canadians capture more of the value from our natural resources rather than shipping it across the border at a discount is, for me, both pragmatic and patriotic. It’s the kind of deal that makes you wonder why anyone would hesitate. Perhaps that hesitation is just a bump in the road of public discourse—something we can gently, politely, and persistently overcome.

I, for one, am excited for the first shipment of LNG out of Canada’s West Coast, due any week now. A top executive with the project once whispered to me that the maiden cargo would be worth $100 million, but lately I’m hearing a single shipload is now probably worth double that.

So yes, I’m looking forward to the day when it’s not just a handful of tankers leaving our ports, but a regular fleet serving global customers. It will lift up the whole country, just as it has contributed to America’s tearaway economy in recent years and elevated Qatar from desert outpost to World Cup host nation.

Soon, maybe all the doubters will have recognized the obvious — and joined the rest of us on the bandwagon with front-row seats to Canada’s LNG future. Sure, I’m biased, but only because the facts keep reinforcing that this sector is poised to do a world of good for Canadians from coast to coast.

-

Alberta3 hours ago

Alberta3 hours agoPremier Smith seeks Alberta Accord: Announces new relationship with Ottawa

-

Energy2 hours ago

Energy2 hours agoIt’s time to get excited about the great Canadian LNG opportunity

-

Crime46 mins ago

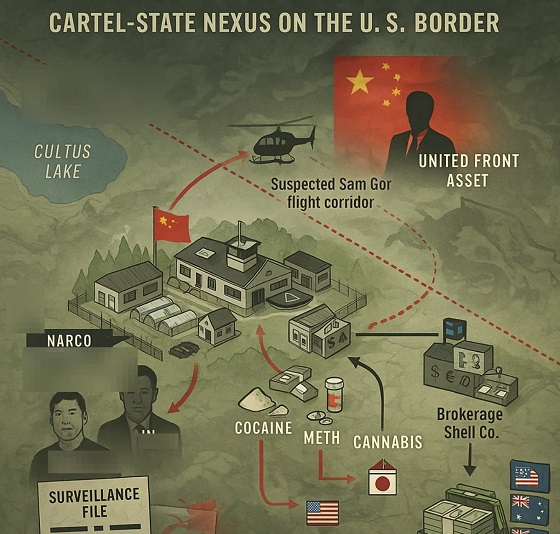

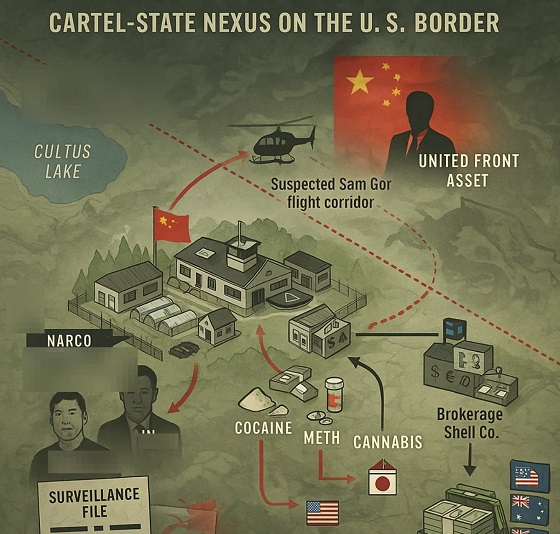

Crime46 mins agoInside B.C.’s Cultus Lake Narco Corridor — How Chinese State-Linked Syndicates are Building a Narco Empire in Canada

-

Energy5 hours ago

Energy5 hours agoIs the Carney Government Prepared to Negotiate a Fair Deal for the Oil, Gas and Pipeline Sectors

-

Health6 hours ago

Health6 hours agoJay Bhattacharya Closes NIH’s Last Beagle Lab

-

Business7 hours ago

Business7 hours agoWelcome to Elon Musk’s New Company Town: ‘Starbase, TX’ Votes To Incorporate

-

Business1 day ago

Business1 day agoFrom ‘Elbows Up’ To ‘Thumbs Up’

-

Daily Caller2 days ago

Daily Caller2 days agoStates Attempting To Hijack National Energy Policy