Business

California planning to double film tax credits amid industry decline

From The Center Square

By

California legislators have unveiled a bill to follow through with the governor’s plan of more than doubling the state’s film and TV production tax credits to $750 million.

The state’s own analysis warns it’s likely the refundable production credits generate only 20 to 50 cents of state revenue for every dollar the state spends, and the increase could stoke a “race to the bottom” among the 38 states that now have such programs.

Industry insiders say the state’s high production costs are to blame for much of the exodus, and experts say the cost of housing is responsible for a significant share of the higher costs.

The bill creates a special carve-out for shooting in Los Angeles, where productions would be able to claim refundable credits for 35% of the cost of production.

California Gov. Gavin Newsom announced his proposal last year and highlighted his goal of expanding the program at an industry event last week.

“California is the entertainment capital of the world – and we’re committed to ensuring we stay that way,” said Newsom. “Fashion and film go hand in hand, helping to express characters, capture eras in time and reflect cultural movements.”

With most states now offering production credits, economic analysis suggests these programs now produce state revenue well below the cost of the credits themselves.

“A recent study from the Los Angeles County Economic Development Corporation found that each $1 of Program 2.0 credit results in $1.07 in new state and local government revenue. This finding, however, is significantly overstated due to the study’s use of implausible assumptions,” wrote the state’s analysts in a 2023 report. “Most importantly, the study assumes that no productions receiving tax credits would have filmed here in the absence of the credit.”

“This is out of line with economic research discussed above which suggests tax credits influence location decisions of only a portion of recipients,” continued the state analysis. “Two studies that better reflect this research finding suggest that each $1 of film credit results in $0.20 to $0.50 of state revenues.”

“Parks and Recreation” stars Rob Lowe and Adam Scott recently shared on Lowe’s podcast how costs are so high their show likely would have been shot in Europe instead.

“It’s cheaper to bring 100 American people to Ireland than to walk across the lot at Fox past the sound stages and do it and do it there,” said Lowe.

“Do you think if we shot ‘Parks’ right now, we would be in Budapest?” asked Scott, who now stars in “Severance.”

“100%,” replied Lowe. “All those other places are offering 40% — forty percent — and then on top of that there’s other stuff that they do, and then that’s not even talking about the union stuff. That’s just tax economics of it all.”

“It’s criminal what California and LA have let happen. It’s criminal,” continued Lowe. “Everybody should be fired.”

According to the Public Policy Institute of California, housing is the single largest expense for California households.

“Across the income spectrum, 35–44% of household expenditures go to covering rent, mortgages, utilities and home maintenance,” wrote PPIC.

The cost of housing due to supply constraints now makes it nearly impossible for creatives to get their start in LA, said M. Nolan Gray, legislative director at housing regulatory reform organization California YIMBY.

“Hollywood depends on Los Angeles being the place where anybody can show up, take a big risk, and pursue their dreams, and that only works if you have a lot of affordable apartments,” said Gray to The Center Square. “We’ve built a Los Angeles where you have to be fabulously wealthy to have stable and decent housing, and as a result a lot of folks either are not coming, or those who are coming need to paid quite a bit higher to make it worth it, and it’s destroying one of California’s most important industries.”

“Anybody who arrived in Hollywood before the 2010s, their story is always, ‘Yeah, I showed up in LA, and I lived in a really, really dirt-cheap apartment with like $10 in my pocket.’ That just doesn’t exist anymore,” continued Gray. “Does the Walt Disney of 2025 not take the train from Kansas City to LA? Almost certainly not. If he goes anywhere, he goes to Atlanta.”

Business

MPs take six-figure send off

News release from the Canadian Taxpayers Federation

Don’t feel too bad for politicians who lost the election because they’re still cashing in big time at your expense.

Defeated or retiring MPs will take about $5 million in annual pension payments from taxpayers. That totals about $187 million by the time they reach the age 90.

The former MPs who didn’t qualify for a pension (because they served for less than six year or are younger than 55) won’t be leaving empty handed.

The severance payment for a former backbencher is just shy of $105,000. There were three MPs who served for less than one year and will still collect a severance. The total severance payments for former MPs will cost taxpayers like you $6.6 million this year.

There are 13 MPs who will take more than $100,000 per year in pensions. The largest annual pension goes to Prince Edward Island’s Lawrence MacAulay, who will take $171,000 in pension payments every year.

If you thought that was bad, just wait until you hear about the golden parachute that is strapped to former prime minister Justin Trudeau.

Trudeau is collecting not one, but TWO pensions from you.

Combined, Trudeau’s two pensions will cost taxpayers $8.4 million, according to CTF estimates. His first pension will cost Canadians $141,000 per year, starting as soon as he turns 55. That first pension will cost taxpayers a total of $6.5 million if he lives to 90.

The second pension is a special bonus just for former prime ministers. It will kick in when Trudeau reaches 67 years old. He’ll be lining his pockets with an extra $73,000 per year, which shakes out to $1.9 million by the time he’s 90 years old.

That’s right. Even after leaving office Trudeau will continue to cost you millions of dollars over the coming years.

Trudeau is also getting a severance payment of $104,900.

So don’t feel too bad for the politicians who you fired during the last election.

Business

The promise and peril of Canadian energy corridors

From Resource Works

“Canada is the largest G7 country in terms of landmass, and the smallest in terms of population. We are the only developed country our size physically and economically without a transportation strategy in place”

The concept of national energy corridors does seem straightforward enough, at first glance. It calls to mind a simple right-of-way that slices across Canada, the world’s second-largest landmass, containing pipelines, railways, telecommunications networks, and electricity grids.

Canadians have seen these sorts of physical infrastructure built before, such as the Canadian Pacific Railway during the Confederation era or the more modern Trans-Canada Highway. However, Garrett Kent Fellows will tell you that the true challenge of a national energy corridor is less about the laying of new steel, and more about the careful weaving of institutions to bind the country together.

An Assistant Professor of Economics at the University of Calgary, Fellows is also the Director of Graduate Programs at the School of Public Policy. He is also a Fellow-in-Residence at the prestigious C.D. Howe Institute, where he specializes in competition policy, energy, and infrastructure economics.

Fellows’ curriculum vitae speaks of a scholar whose expertise is routinely sought by politicians, the business community, and thought leaders both in Canada and internationally. He formerly served on Alberta’s Energy Diversification Advisory Committee in 2017, as well as the Economic Corridors Task Force in 2021, and has provided advice to officials from the European Union and the Canadian Senate on economic trade corridors.

At any rate, whenever Fellows has something to say about corridors, people with power and influence listen.

There is a great misunderstanding related to the idea of corridors, which results in an idealized, simplified vision that politicians tend to champion.

“We have a tendency to think about corridors first and foremost as a physical footprint. A right-of-way or area of the country where we are going to put linear infrastructure. That’s not wrong; corridors are that, but they are also an institution,” says Fellows. To him, a national corridor must involve more than simple geography.

A corridor’s success depends upon deep institutional cooperation between all levels of government, First Nations authorities, and the private sector. This is a reality that comes with more challenges than leaders in Ottawa or provincial capitals will care to admit.

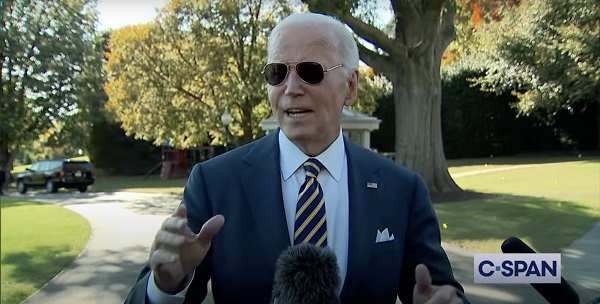

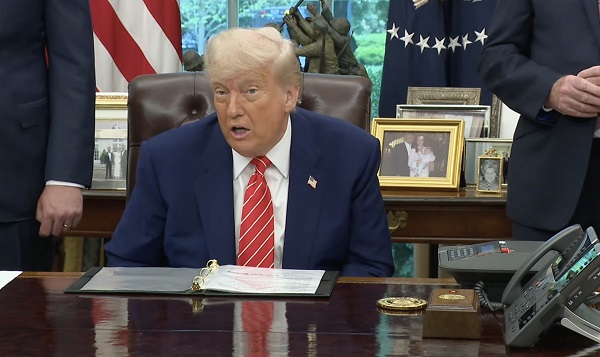

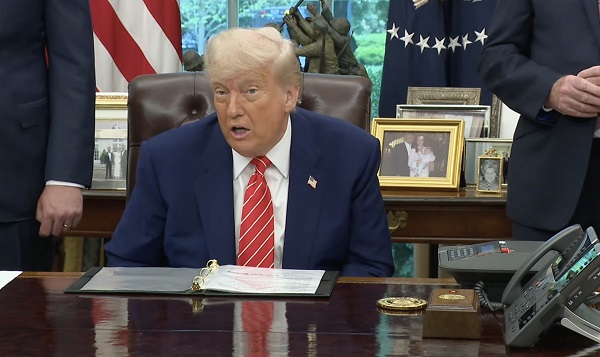

Nonetheless, the need for corridors has taken on much greater urgency. The world economy is uncertain, and the threat of trade wars instigated by Donald Trump’s return to the White House has only exacerbated this. Trump’s aggressive tariff policy has revealed the shocking vulnerability of the Canadian economy, which depends on exports.

Fellows is quick to point out that Canada, being massive but sparsely populated, is uniquely exposed as the largest G7 country while having the smallest population and lacking adequate transportation strategies.

“Canada is the largest G7 country in terms of landmass, and the smallest in terms of population. We are the only developed country our size physically and economically without a transportation strategy in place,” Fellows says. This weakness has only strengthened the need for a better-coordinated infrastructure plan that goes beyond simply easing exports, but also increasing Canada’s national economic resilience.

Canada’s history has been marked by impressive infrastructure projects built during periods of hardship, often utilized to boost employment and add to the economic recovery effort. Fellows can see some parallels between the climate of 2025 and the boom in infrastructure construction during the Great Depression.

In the 1930s, projects like the Trans-Canada Highway were developed as part of the federal government’s policy of fiscal stimulus. However, Fellows cautions against simply moving forward with corridor projects as a means of boosting economic security and employment, and says that they are not quick-fix solutions.

“Properly implementing a corridor approach shouldn’t be seen as a shortcut. So it may not be productive to think about this project as shovel-ready.”

Fellows’ concerns are rooted in history, as regulatory uncertainty and rushed processes have contributed to setbacks in the energy sector, such as the cancellation of the Northern Gateway pipeline, the tortured delays on the expansion of the Trans Mountain pipeline, and the death of the Energy East project.

Despite this, the potential of energy corridors remains a compelling and intriguing possibility. Fellows points out that investing in new infrastructure can provide an effective stimulus that remedies stagflationary pressures caused by world trade disputes. “Fiscal stimulus is a natural reaction to stagflation, and a logical one. But we should be thinking about a stimulus that will generate long-term benefits for the country.”

With this approach, stimulus borne of corridors is not just about economic recovery, but also ensuring that it leaves a permanent productive legacy for Canada that helps to secure long-term prosperity instead of temporary relief.

The promise of the corridor also includes the potential of untangling the web of regulations and other complexities that dog new projects. This can be accomplished by improving pre-planning and the environmental assessment process, which can prevent cold feet from investors. Fellows emphasizes that building a better regulatory environment requires cooperation between multiple stakeholders and due diligence.

Fellows is frank about the risk involved, such as stranded capital and white elephants left to rust when market conditions or political priorities change. “As with any infrastructure-based program, there is a risk of stranded capital. We can’t simply take the view that ‘if we build it, they will come.’”

However, he remains firm in his belief that the benefits justify the careful, purposeful efforts required. One of his most interesting insights is that the corridors themselves should not be solely defined as “energy corridors.” Rather, Fellows argues that the model has to bring together diverse infrastructure, telecommunications, transportation, renewable energy transmission, and critical mineral supply chains.

“To maximize the benefits of the corridor approach, we need to be thinking beyond just ‘energy corridors’ and think more broadly about economic corridors.” The rewards of this more holistic vision would lift domestic and international trade and create a foundation for Canada to build a more diversified and resilient economy.

Fellows also hammers home that the idea of corridors lends itself to idealism, but they still demand that people think realistically and be prepared for hard-headed analysis. Corridors are challenging, full of details, bureaucratic, institutional, and diplomatic—hardly an easy task. “Shortcuts make for long delays.”

Being aware of past failures in this regard is important, but Fellows says this makes the difference between accomplishing goals and spouting political rhetoric.

“Realization of any corridor is going to be hard work, but it will be worth it.”

-

Energy1 day ago

Energy1 day agoTrump signs executive orders to help nuclear industry in U.S.

-

Alberta2 days ago

Alberta2 days agoAs LNG opens new markets for Canadian natural gas, reliance on U.S. to decline: analyst

-

International19 hours ago

International19 hours agoHarvard sues Trump Administration over foreign student ban

-

International18 hours ago

International18 hours agoSecDef Hegseth orders “comprehensive review” of Biden Afghanistan withdrawal

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe WHO Cannot Be Saved

-

Artificial Intelligence17 hours ago

Artificial Intelligence17 hours agoNew AI Model Would Rather Ruin Your Life Than Be Turned Off, Researchers Say

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoRCMP seem more interested in House of Commons Pages than MP’s suspected of colluding with China

-

Business2 days ago

Business2 days agoTrump threatens 50% tariffs on EU, 25% tariffs on iPhones