Business

The Great Wealth Transfer – Billions To Change Hands By 2026

Here comes the boom.

What is ‘The Great Wealth Transfer’?

This term has been coined by several major wealth managers across North America; referring to the tremendous amount of wealth that will be transferred to younger generations over the next decade. Wealth amassed by baby boomers will eventually be passed down to their families or beneficiaries, typically with the aid of a trusted wealth manager or financial advisor.

Similar in a way to climate change, when we visit some of the data that has been reported in both Canada and the US, this issue seems to be far more pressing than most people are aware. Depending on the publication, the exact amount of wealth that will be transferred is questionable. Cited in Forbes, a report done by the Coldwell Banker Global Luxury® program and WealthEngine claim that $68 Trillion will change hands in the US by 2030.

We spoke with Gwen Becker and Devin St. Louis, two VP’s, Portfolio Managers and Wealth Advisors for RBC Wealth Management, offering their expert insight into the industry and the vast amount of wealth that is changing hands in Canada.

According to RBC Wealth Management, their numbers in terms of the wealth transfer report $150 billion is set to change hands by 2026. The industry as a whole is at the forefront of this generational shift, whereas a trusted advisor can onboard younger family members to ensure the highest level of support through the process. Gwen offers her perspective:

“Certainly just around the corner; something that we are definitely paying attention to. My practice has always been very relationship-driven. It has been my privilege to advise many of my clients for decades. I have been intentional to welcome and include multiple generations of the same family. I advise grandparents who are now in their 90s, to which the majority of their children are my clients and even beginning to onboard grandchildren.”

This is an example of what is referred to as multi-generational estate planning. Being in the midst of the ‘great transfer of wealth’, this type of planning is crucial for advisors to implement early so they can continue to support the same family in the future. According to the Canadian Financial Capability Survey conducted in 2019, 51% of Canadians over the age of 65 will refer to a financial advisor to seek literacy and support. Contrary to that, Canadians aged 18-34 show that 51% are more likely to use online resources to aid in their financial literacy.

Devin offers his perspective on how the importance of family legacy plays a role when an advisor poses this question: What is your wealth for?

“If you sat down with a couple 10 years ago, they may say, when I pass away, whatever wealth is left can be distributed evenly amongst our children. That has changed quite a lot now because elder family members are now more concerned about how their wealth is passed on to the next generation. Onboarding grandchildren can ensure that a family legacy that receives their wealth, uses it to benefit their family and their community.”

An important question to consider. Clearly there is a shift in attitude towards having a family legacy live on through younger generations of a family. Evident that having the support of a financial advisor or wealth manager not only ensures the most efficient use of your money and assets but also ensures financial stability for your family in their future.

If we revisit the above study in how a younger demographic is more likely to utilize online resources, interesting how a more digitally inclined audience will be receptive to advisors. Boiling down to how millennials and younger age groups will perceive wealth management if those in that space fail to offer their services through online communication.

Devin agrees that RBC is uniquely positioned for this digital shift:

“interesting that everybody had to transform their processes online through this COVID-19 pandemic. Every company has been forced to step up their technology means, RBC has definitely risen to that occasion. RBC has adapted quickly, improving a great technology base that already existed. I don’t perceive it at this point to be a challenge. I believe we have the right focus. I think it’ll be a good transition for us.”

Gwen continues:

“I do agree that RBC is very well positioned. The younger generations below millennials that would eventually take over some of this wealth carries some challenges. How does that age demographic think, and what are their expectations of wealth management or financial advisors? It is difficult to understand what that generation will expect out of digital advisors. Estate planning matters, and it will always be tied to you knowing the family, it’s a relationship business”

Consider that RBC Wealth Management oversees $1.05 trillion globally under their administration, has over 4,800 professionals to serve their clients and was the recipient of the highest-ranking bank-owned investment brokerage by the 2020 Investment Executive Brokerage Report Card, safe to say their decades of professionalism, expertise and ‘get it done’ attitude speaks for itself.

So, what does this mean for younger members of families who may not understand the field of wealth management?

Starting the conversation early

Whether you are the elder family member who has their financial ‘quarterback’ preparing their estate to change hands or are younger family members who may be the beneficiary of wealth in the near future, starting the conversation amongst family members early is important for the process to be successful. Considering that some possessions have more than just monetary value, but an emotional tie to the family legacy can be a difficult asset to distribute evenly. Of course, it can be a tough conversation to have, it may involve discussing the passing away of a loved one or even setting a plan to cover future expenses. Gwen mentions:

“I encourage my clients to have open conversations with their children while they are alive so that their intentions are clear. Depending on the dynamics of the family, things such as an annual family meeting with a beneficiary can be effective once it’s put in place. If they are not comfortable leading that conversation, bring a trusted adviser to the table to be impartial and logical.”

There is no way to know what ramifications will come of this ‘great transfer of wealth’. It may be that we see the resurgence of a strong bull market in the near future, we may see new tech innovation that we cannot yet grasp or new business investments that continue to disrupt traditional processes. Only time will tell.

For more stories, visit Todayville Calgary

Automotive

EV fantasy losing charge on taxpayer time

From the Fraser Institute

By Kenneth P. Green

The vision of an all-electric transportation sector, shared by policymakers from various governments in Canada, may be fading fast.

The latest failure to charge is a recent announcement by Honda, which will postpone a $15 billion electric vehicle (EV) project in Ontario for two years, citing market demand—or lack thereof. Adding insult to injury, Honda will move some of its EV production to the United States, partially in response to the Trump Tariff Wars. But any focus on tariffs is misdirection to conceal reality; failures in the electrification agenda have appeared for years, long before Trump’s tariffs.

In 2023, the Quebec government pledged $2.9 billion in financing to secure a deal with Swedish EV manufacturer NorthVolt. Ottawa committed $1.34 billion to build the plant and another $3 billion worth of incentives. So far, per the CBC, the Quebec government “ invested $270 million in the project and the provincial pension investor, the Caisse de dépôt et placement du Québec (CDPQ), has also invested $200 million.” In 2024, NorthVolt declared bankruptcy in Sweden, throwing the Canadian plans into limbo.

Last month, the same Quebec government announced it will not rescue the Lion Electric company from its fiscal woes, which became obvious in December 2024 when the company filed for creditor protection (again, long before the tariff war). According to the Financial Post, “Lion thrived during the electric vehicle boom, reaching a market capitalization of US$4.2 billion in 2021 and growing to 1,400 employees the next year. Then the market for electric vehicles went through a tough period, and it became far more difficult for manufacturers to raise capital.” The Quebec government had already lost $177 million on investments in Lion, while the federal government lost $30 million, by the time the company filed for creditor protection.

Last year, Ford Motor Co. delayed production of an electric SUV at its Oakville, Ont., plant and Umicore halted spending on a $2.8 billion battery materials plant in eastern Ontario. In April 2025, General Motors announced it will soon close the CAMI electric van assembly plant in Ontario, with plans to reopen in the fall at half capacity, to “align production schedules with current demand.” And GM temporarily laid off hundreds of workers at its Ingersoll, Ontario, plant that produces an electric delivery vehicle because it isn’t selling as well as hoped.

There are still more examples of EV fizzle—again, all pre-tariff war. Government “investments” to Stellantis and LG Energy Solution and Ford Motor Company have fallen flat and dissolved, been paused or remain in limbo. And projects for Canada’s EV supply chain remain years away from production. “Of the four multibillion-dollar battery cell manufacturing plants announced for Canada,” wrote automotive reporter Gabriel Friedman, “only one—a joint venture known as NextStar Energy Inc. between South Korea’s LG Energy Solution Ltd. and European automaker Stellantis NV—progressed into even the construction phase.”

What’s the moral of the story?

Once again, the fevered dreams of government planners who seek to pick winning technologies in a major economic sector have proven to be just that, fevered dreams. In 2025, some 125 years since consumers first had a choice of electric vehicles or internal combustion vehicles (ICE), the ICE vehicles are still winning in economically-free markets. Without massive government subsidies to EVs, in fact, there would be no contest at all. It’d be ICE by a landslide.

In the face of this reality, the new Carney government should terminate any programs that try to force EV technologies into the marketplace, and rescind plans to have all new light-duty vehicle sales be EVs by 2035. It’s just not going to happen, and planning for a fantasy is not sound government policy nor sound use of taxpayer money. Governments in Ontario, Quebec and any other province looking to spend big on EVs should also rethink their plans forthwith.

Business

Switzerland has nearly 65% more doctors and much shorter wait times than Canada, despite spending roughly same amount on health care

From the Fraser Institute

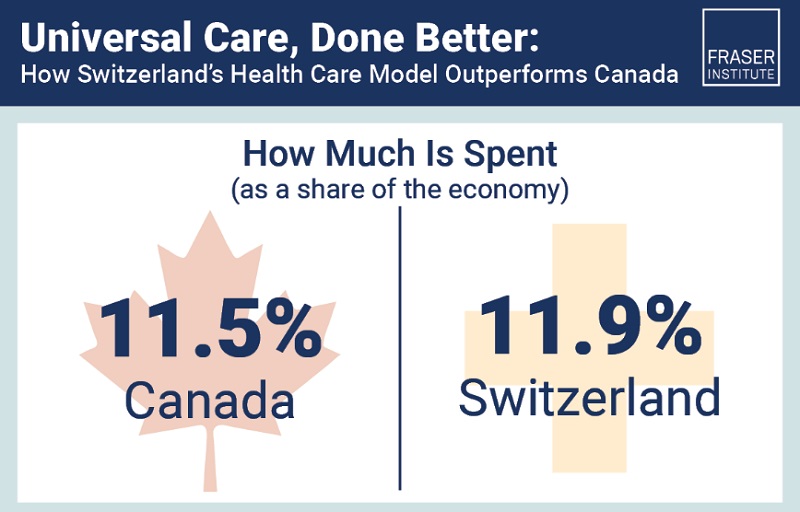

Switzerland’s universal health-care system delivers significantly better results than Canada’s in terms of wait times, access to health professionals like doctors and nurses, and patient satisfaction finds a new study published by the Fraser Institute, an independent, non-partisan Canadian policy think-tank.

“Despite its massive price tag, Canada’s health-care system lags behind many other countries with universal health care,” said Yanick Labrie, senior fellow at the Fraser Institute and author of Building Responsive and Adaptive Health-Care Systems in Canada: Lessons from Switzerland.

The study highlights how Switzerland’s universal health-care system consistently outperforms Canada on most metrics tracked by the OECD.

In 2022, the latest year of available data, despite Canada (11.5 per cent of GDP) and Switzerland (11.9 per cent) spending close to the same amount on health care, Switzerland had 4.6 doctors per thousand people compared to 2.8 in Canada. In other words, Switzerland had 64.3 per cent more doctors than Canada (on a per-thousand people basis).

Switzerland also had 4.4 hospital beds per thousand people compared to 2.5 for Canada—Switzerland (8th) outranked Canada (36th) on this metric out of 38 OECD countries with universal health care.

Likewise, 85.3 per cent of Swiss people surveyed by the CWF (Commonwealth Fund) reported being able to obtain a consultation with a specialist within 2 months. By comparison, only 48.3 per cent of Canadians experienced a similar wait time. Beyond medical resources and workforce, patient satisfaction diverges sharply between the two countries, as 94 per cent of Swiss patients report being satisfied with their health-care system compared to just 56 per cent in Canada.

“Switzerland shows that a universal health care system can reconcile efficiency and equity – all while being more accessible and responsive to patients’ needs and preferences,” Labrie said.

“Policymakers in Canada who hope to improve Canada’s broken health-care system should look to more successful universal health-care countries like Switzerland.”

Building Responsive and Adaptive Health Care Systems in Canada: Lessons from Switzerland

- Canada’s health-care system is increasingly unable to meet patient needs, with wait times reaching record lengths—over 30 weeks for planned care in 2024—despite significantly rising public spending and growing dissatisfaction among patients and providers nationwide.

- Swiss health care outperforms Canada in nearly all OECD performance indicators: more doctors and nurses per capita, better access to care, shorter wait times, lower unmet needs, and higher patient satisfaction (94% vs. Canada’s 56%).

- Switzerland ensures universal coverage through 44 competing private, not-for-profit insurers. Citizens are required to enroll but have the freedom to choose insurers and tailor coverage to their needs and preferences, promoting both access and autonomy.

- Swiss basic insurance coverage is broader than Canada’s, including outpatient care, mental health, prescribed medications, home care, and long-term care—with modest, capped cost-sharing, and exemptions for vulnerable groups, including children, low-income individuals, and the chronically ill.

- Patient cost participation (deductibles/co-payments) exists, but the system includes robust financial protection: 27.5% of the population receives direct subsidies, ensuring affordability and equity.

- Risk equalization mechanisms prevent risk selection and guarantee insurer fairness, promoting solidarity across demographic and health groups.

- Decentralized governance enhances responsiveness; cantons manage service planning, ensuring care adapts to local realities and population needs.

- Managed competition drives innovation and efficiency: over 75% of the Swiss now choose alternative models (e.g., HMOs, telemedicine, gatekeeping).

- The Swiss model proves that a universal, pluralistic, and competitive system can reconcile efficiency, equity, access, and patient satisfaction—offering powerful insights for Canada’s stalled health reform agenda.

-

Crime2 days ago

Crime2 days ago“A Dangerous Experiment”: Doctor Says Ideological Canadian Governments Ignored Evidence as Safer Supply Exacerbated Fentanyl Death Surge

-

National1 day ago

National1 day agoMajority of Canadians want feds to focus on illegal gun smuggling not gun buyback program

-

espionage17 hours ago

espionage17 hours agoTrudeau Government Unlawfully Halted CSIS Foreign Operation, Endangering Officers and Damaging Canada’s Standing With Allies, Review Finds

-

Alberta2 days ago

Alberta2 days agoCanadian doctors claim ‘Charter right’ to mutilate gender-confused children in Alberta

-

Alberta1 day ago

Alberta1 day agoWhy The Liberal’s Real Estate Economy Could Push Alberta Out of Canada

-

Health1 day ago

Health1 day agoRFK Jr. cancels $700 million mRNA bird flu ‘vaccine’ contract with Moderna over safety concerns

-

Health1 day ago

Health1 day agoRFK Jr. announces plan for US, Argentina to create alternative to globalist WHO

-

Energy1 day ago

Energy1 day agoThe environmental case for Canadian LNG