Energy

Navigating New Political Currents: How the U.S. Election Could Impact Canadian Energy – Resource Works

From EnergyNow.ca

By Resource Works

More News and Views From Resource Works Here

As Stewart Muir, CEO of Resource Works, attends the annual Pacific North West Economic Region (PNWER) conference in Whistler this week, the unexpected news that President Joe Biden won’t be on the November 5 presidential ballot sent shockwaves through the policy and trade discussions.

For policy wonks like those I’m gathered with in Whistler this week, could there be a better gift than the conundrums unleashed over the past week onto the U.S. political landscape?

The rise of Donald Trump and the potential presidential candidacy of Kamala Harris conjure up a staggering range of possibilities. When it comes to trade, international relations, and the future of the foundational natural resource sectors that unify the ten sub-national jurisdictions making up PNWER, this is what everyone is going to be talking about..

With Trump securing the Republican nomination last week, Canadian energy producers were left pondering what his potential return to the White House might mean for their industry. Like a wildcatter drilling an exploratory well, Trump’s energy policies promise both gushers of opportunity and dry holes of risk for our oil and gas sector.

On the upside, his pledge to unleash American energy production could boost overall demand and prices, indirectly benefiting Canadian exporters. His promised regulatory reforms may also grease the wheels for new pipelines and LNG terminals, easing the flow of our energy products southward. It’s enough to make an Albertan oilman shed a tear of joy into his Stampede pancakes.

But before we break out the champagne (or perhaps a nice Canadian ice wine), consider the potential downsides. Trump’s “America First” trade policies and tariff threats loom like storm clouds on the horizon for Canadian exporters. His vow to gut environmental regulations faster than you can say “EPA” could leave Canadian producers at a competitive disadvantage, burdened by our quaint commitment to responsible production practices.

Yet in this potential regulatory race to the bottom, I spy an opportunity as golden as the fields of Saskatchewan canola. By doubling down on our world-class environmental and safety standards, Canadian energy could position itself as the responsible choice in global markets.

Picture it: “Canadian crude – now with 50% less guilt!” We could be the Tesla of fossil fuels, if you will.

Of course, there’s a risk in tooting our own sustainability horn too loudly. Trump isn’t known for his fondness of perceived criticism, and antagonizing him could lead to retaliatory tariffs faster than you can say “covfefe.” We’ll need to navigate this terrain as carefully as a pipeline through the Rockies.

On the other hand, if Kamala Harris, Biden’s preferred successor, retakes the White House, the landscape will look markedly different. Harris is likely to continue the Biden administration’s focus on climate action and clean energy. This could mean stronger support for renewables, potentially benefiting Canadian sectors involved in green technology and clean energy exports. However, stricter environmental regulations and a push for rapid decarbonization might challenge traditional oil and gas industries.

A Harris administration might prioritize cross-border collaboration on climate initiatives, providing opportunities for joint projects in carbon capture and storage (CCS), hydrogen development, and renewable energy. This could foster closer ties and create a more integrated North American energy market focused on sustainability.

Bloomberg reports that while Harris wouldn’t be likely to make major shifts to the direction Biden charted on climate change, her opposition to offshore drilling and fracking suggests her signature move as president could be bringing fierce oil industry antagonism to the White House. As California attorney general, she brought lawsuits against energy companies, prosecuted a pipeline company over an oil leak and investigated Exxon Mobil Corp. for misleading the public about climate change.

Yet, such a focus on environmental standards could also mean increased scrutiny and regulatory hurdles for Canadian energy projects seeking to enter the U.S. market. Canadian producers will need to balance compliance with high environmental standards while remaining competitive.

In either scenario, navigating the U.S. political landscape will require strategic adaptability from Canadian energy producers. Trump’s potential return could mean deregulation and a push for fossil fuel dominance, while a Harris presidency could emphasize clean energy and environmental collaboration.

And for anyone lamenting the potential Trump threat to renewables growth, remember the number one test for The Donald: “Can I make money off it?” From Texas to Alberta, solar is a huge growth opportunity in the “and more” rather than the “and/or” category of energy opportunities that are creating investor profits. There’s no reason for him to fire opportunities like those.

Speaking of careful navigation, let’s ponder the electric vehicle conundrum. If Trump follows through on scrapping EV mandates, Canada may find itself stuck between a Chevy Bolt and a hard place. Do we follow suit and risk our climate goals, or forge ahead solo and risk becoming an automotive island? It’s enough to make one long for the simpler days of the horse and buggy.

But fear not, dear reader. For in the potential pairing of a Trump presidency and a Pierre Poilievre prime ministership, I see a silver lining as shiny as a freshly polished oil rig. Their aligned views on energy could usher in a new era of continental cooperation, turning the 49th parallel into a veritable pipeline of mutual prosperity. If current trends of market-driven decarbonization continue, this would actually be positive for the climate (and yes, I can already hear the chorus of those saying such a thing is impossible).

In the end, navigating the Trump energy landscape will require all the nimbleness of a Fort McMurray worker on an icy road. But with a dash of ingenuity, a sprinkle of diplomacy, and perhaps a generous helping of maple syrup to sweeten the deal, Canadian energy producers may yet find themselves not just surviving, but thriving in the turbulent waters of a potential Trump 2.0 era.

Energy

Oil tankers in Vancouver are loading plenty, but they can load even more

From Resource Works

Despite years of protest, ballooning costs, and political hurdles, the federally funded TMX pipeline expansion has become a strategic economic success story for Canada.

The federally funded expansion of the Trans Mountain oil pipeline from Alberta to tidewater at Burnaby has been much attacked by critics, but has quickly turned into a gold-star success story.

The 980-km expansion, known as TMX, opened in May 2024, almost tripling the capacity of the original (1953) Trans Mountain Pipeline. Since then, TMX has enabled major expansion of our crude oil exports to American and Asian buyers.

It is, says Trans Mountain CEO Mark Maki, “one of the most strategic investments Canada has ever made,” providing Canada with new trading options to Pacific Rim nations in the face of Donald Trump’s tariffs, and bringing in billions in new revenues.

Since opening on May 1, 2024, Trans Mountain has sent half of its tanker shipments to countries other than the US, and half to refineries on the US west coast.

Alberta Central chief economist Charles St-Arnaud said in a report earlier this year that TMX had brought in an extra $10 billion in revenues in 2024, equivalent to “adding a thirteenth month of production to the year.”

The export picture would be even brighter if the Port of Vancouver could accommodate larger loads in departing oil tankers, and that now is being addressed by both federal and provincial governments.

Right now, 245-metre-long Aframax-size tankers can handle up to 120,000 tonnes of oil. But under our port restrictions and limited depths of water in Burrard Inlet, they usually load only up to 96,000 tonnes.

In the BC legislature, Gavin Dew, Conservative MLA for Kelowna-Mission and the Opposition critic for jobs, economic development and innovation, asked if BC and the new federal government are indeed supporting dredging Burrard Inlet to allow fully laden Aframax oil tankers.

The simple reply from Adrian Dix, BC’s minister of energy and climate solutions: “Yes.”

Dix added later in an interview that the idea most recently came from Prime Minister Mark Carney. “Broadly, the premier and us have indicated our support for it,” Dix said.

No plan or timing has yet been announced.

While fully loaded Aframax tankers would carry more oil, they still have to meet requirements that include these: All tankers calling at the Westridge Marine Terminal must first be pre-screened by Trans Mountain to ensure criteria are met for safety and reliability; They must be double-hulled, and have segregated internal cargo tanks; They must have two radar systems in working order, one of them being a specialized collision-avoidance radar. For loading, a containment boom is deployed to enclose the tanker and its berth while loading. The tankers are escorted by tugs, and carry a fully qualified and licensed marine pilot.

There are also upgraded emergency facilities to cope with any spill, but Trans Mountain notes that there has not been a single oil spill from one of its tankers since the original pipeline opened in 1956.

The terminal now can handle some 34 tankers a month.

While a success story now, the TMX expansion went through a lot of pain, protest, obstruction, money, and red tape to get there.

The expansion was first proposed in 2012 by the Canadian division of US pipeline giant Kinder Morgan Inc., which bought the original Trans Mountain pipeline in 2005. It applied in December 2013 for federal approval of expansion, and estimated the cost at $5.4 billion.

The expansion proposal then ran into endless protests, opposition from the BC government (then-premier John Horgan promised to use “every tool in the toolbox” to stop the expansion), and a federal approval process that took almost three years of red tape.

Ottawa’s approval finally came with 157 conditions, and BC’s “toolbox” now included restrictions on any increase in diluted bitumen shipments pending further studies.

By 2018, Kinder Morgan Canada said estimated costs had risen to $7.4 billion, and the company began to send up distress signals.

Ottawa then bought TMX from Kinder Morgan for $4.5 billion, calling the purchase “a serious and necessary investment made in the national interest.”

The feds added: “The completion of this important infrastructure project is making Canada and the Canadian economy more resilient by diversifying global market access for our resources.”

Construction began in the Edmonton area in November 2019. By 2020, though, Trans Mountain said the cost of the expansion had risen to $12.6 billion, and in 2022 the cost was estimated at $21.4 billion, the impact of the COVID-19 pandemic among the reasons. In March 2023, Trans Mountain put the cost at $30.9 billion.

Some of the benefits listed by Ottawa: Opening new markets for Canadian energy exports, reducing our reliance on a single customer, and ensuring that Canada receives fair market value for its resources while maintaining the highest environmental standards; Significantly increasing the royalties and tax revenues that all levels of government receive: According to an independent study, TMX is expected to add $9.2 billion in GDP and $2.8 billion in tax revenues between 2024 and 2043; Contributing to global and regional energy security by providing a secure, long-term supply of energy; Creating economic benefits for many Indigenous groups through contracting, financial compensation, and employment and training opportunities.

But Ottawa has said all along that it would not own the pipeline forever, and that at some point it will divest itself of ownership, and make at least partial ownership available to Indigenous groups.

Trans Mountain CEO Mark Maki now wonders if the feds might postpone that divestment, particularly if they decide TMX shouldn’t be the last oil export pipeline built in Canada.

We await word from the new federal government on its plans.

Alberta

Energy projects occupy less than three per cent of Alberta’s oil sands region, report says

From the Canadian Energy Centre

By Will Gibson

‘Much of the habitat across the region is in good condition’

The footprint of energy development continues to occupy less than three per cent of Alberta’s oil sands region, according to a report by the Alberta Biodiversity Monitoring Institute (ABMI).

As of 2021, energy projects impacted just 2.6 per cent of the oil sands region, which encompasses about 142,000 square kilometers of boreal forest in northern Alberta, an area nearly the size of Montana.

“There’s a mistaken perception that the oil sands region is one big strip mine and that’s simply not the case,” said David Roberts, director of the institute’s science centre.

“The energy footprint is very small in total area once you zoom out to the boreal forest surrounding this development.”

Between 2000 and 2021, the total human footprint in the oil sands region (including energy, agriculture, forestry and municipal uses) increased from 12.0 to 16.5 per cent.

At the same time, energy footprint increased from 1.4 to 2.6 per cent – all while oil sands production surged from 667,000 to 3.3 million barrels per day, according to the Alberta Energy Regulator.

The ABMI’s report is based on data from 328 monitoring sites across the Athabasca, Cold Lake and Peace River oil sands regions. Much of the region’s oil and gas development is concentrated in a 4,800-square-kilometre zone north of Fort McMurray.

“In general, the effects of energy footprint on habitat suitability at the regional scale were small…for most species because energy footprint occupies a small total area in the oil sands region,” the report says.

Researchers recorded species that were present and measured a variety of habitat characteristics.

The status and trend of human footprint and habitat were monitored using fine-resolution imagery, light detection and ranging data as well as satellite images.

This data was used to identify relationships between human land use, habitat and population of species.

The report found that as of 2021, about 95 per cent of native aquatic and wetland habitat in the region was undisturbed while about 77 per cent of terrestrial habitat was undisturbed.

Researchers measured the intactness of the region’s 719 plant, insect and animal species at 87 per cent, which the report states “means much of the habitat across the region is in good condition.”

While the overall picture is positive, Roberts said the report highlights the need for ongoing attention to vegetation regeneration on seismic lines along with the management of impacts to species such as Woodland Caribou.

The ABMI has partnered with Indigenous communities in the region to monitor species of cultural importance. This includes a project with the Lakeland Métis Nation on a study tracking moose occupancy around in situ oil sands operations in traditional hunting areas.

“This study combines traditional Métis insights from knowledge holders with western scientific methods for data collection and analysis,” Roberts said.

The institute also works with oil sands companies, a relationship that Roberts sees as having real value.

“When you are trying to look at the impacts of industrial operations and trends in industry, not having those people at the table means you are blind and don’t have all the information,” Roberts says.

The report was commissioned by Canada’s Oil Sands Innovation Alliance, the research arm of Pathways Alliance, a consortium of the six largest oil sands producers.

“We tried to look around when we were asked to put together this report to see if there was a template but there was nothing, at least nothing from a jurisdiction with significant oil and gas activity,” Roberts said.

“There’s a remarkable level of analysis because of how much data we were able to gather.”

-

Alberta7 hours ago

Alberta7 hours agoPremier Smith seeks Alberta Accord: Announces new relationship with Ottawa

-

Energy6 hours ago

Energy6 hours agoIt’s time to get excited about the great Canadian LNG opportunity

-

Crime5 hours ago

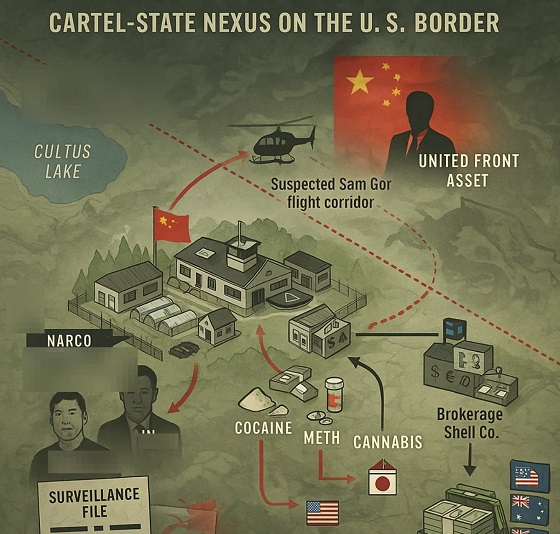

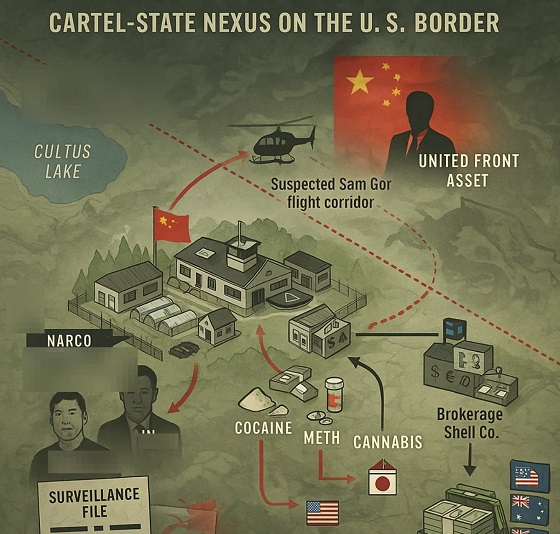

Crime5 hours agoInside B.C.’s Cultus Lake Narco Corridor — How Chinese State-Linked Syndicates are Building a Narco Empire in Canada

-

Energy9 hours ago

Energy9 hours agoIs the Carney Government Prepared to Negotiate a Fair Deal for the Oil, Gas and Pipeline Sectors

-

Health10 hours ago

Health10 hours agoJay Bhattacharya Closes NIH’s Last Beagle Lab

-

Business11 hours ago

Business11 hours agoWelcome to Elon Musk’s New Company Town: ‘Starbase, TX’ Votes To Incorporate

-

Alberta3 hours ago

Alberta3 hours agoEnergy projects occupy less than three per cent of Alberta’s oil sands region, report says

-

Daily Caller4 hours ago

Daily Caller4 hours agoMisguided Climate Policies Create ‘Real Energy Emergency’ And Permit China To Dominate US