Alberta

UPDATE: RDC scrambling to help students after University of Calgary suspends admission to collaborative degrees

From Red Deer College Communications

UPDATE: While new students are not being accepted by U of C to begin classes at RDC in fall 2020, more than 100 current students who are attending RDC will be able to complete their degree at the College.

University of Calgary suspends admission to its collaborative degrees at Red Deer College

Students in Bachelor of Arts and Bachelor of Science affected

The University of Calgary (U of C) has informed its partners at Red Deer College (RDC) of a decision to cancel admission to its collaborative degree offerings. This decision affects U of C students enrolled in the Bachelor of Arts (majoring in Sociology and Psychology) and Bachelor of Science (majoring in Psychology) who attend RDC.

“We are very disappointed with the University of Calgary’s decision,” says Dr. Peter Nunoda, Red Deer College President. “Under these difficult circumstances, we are committed to working with the U of C and with our current students in the affected programs to ensure all students can successfully complete their degrees.”

At this time, the University of Calgary has committed to offering courses at RDC until April 2021. While new students are not being accepted by U of C to begin classes at RDC in fall 2020, more than 100 current students who are attending RDC will be able to complete their degree at the College.

Red Deer College will continue to accept applications from new students who are able to complete the first two years of a Bachelor of Arts and Bachelor of Science degrees and then complete their degrees by transferring to another post-secondary institution.

For the last two decades, collaborative degrees have provided RDC students the opportunity to complete their studies in Red Deer, while receiving their degree from a partner institution, such as the University of Calgary. Students enrolled in other collaborative degrees at RDC are unaffected.

“We know there is a demand for degree programs to be offered in central Alberta. We look forward to creating more opportunities for students as we begin to offer our own degrees as Red Deer University,” says Dr. Nunoda.

Red Deer College is moving swiftly to complete proposals to offer its first bachelor degrees in Arts, Education, Science (majoring in Biological Sciences) and Business Administration. Pending government approvals, students could begin classes in these degrees at Red Deer University as early as September 2021.

Alberta

Alberta’s oil bankrolls Canada’s public services

This article supplied by Troy Media.

By Perry Kinkaide and Bill Jones

By Perry Kinkaide and Bill Jones

It’s time Canadians admitted Alberta’s oilpatch pays the bills. Other provinces just cash the cheques

When Canadians grumble about Alberta’s energy ambitions—labelling the province greedy for wanting to pump more oil—few stop to ask how much

money from each barrel ends up owing to them?

The irony is staggering. The very provinces rallying for green purity are cashing cheques underwritten not just by Alberta, but indirectly by the United States, which purchases more than 95 per cent of Alberta’s oil and gas, paid in U.S. dollars.

That revenue doesn’t stop at the Rockies. It flows straight to Ottawa, funding equalization programs (which redistribute federal tax revenue to help less wealthy provinces), national infrastructure and federal services that benefit the rest of the country.

This isn’t political rhetoric. It’s economic fact. Before the Leduc oil discovery in 1947, Alberta received about $3 to $5 billion (in today’s dollars) in federal support. Since then, it has paid back more than $500 billion. A $5-billion investment that returned 100 times more is the kind of deal that would send Bay Street into a frenzy.

Alberta’s oilpatch includes a massive industry of energy companies, refineries and pipeline networks that produce and export oil and gas, mostly to the U.S. Each barrel of oil generates roughly $14 in federal revenue through corporate taxes, personal income taxes, GST and additional fiscal capacity that boosts equalization transfers. Multiply that by more than 3.7 million barrels of oil (plus 8.6 billion cubic feet of natural gas) exported daily, and it’s clear Alberta underwrites much of the country’s prosperity.

Yet many Canadians seem unwilling to acknowledge where their prosperity comes from. There’s a growing disconnect between how goods are consumed and how they’re produced. People forget that gasoline comes from oil wells, electricity from power plants and phones from mining. Urban slogans like “Ban Fossil Fuels” rarely engage with the infrastructure and fiscal reality that keeps the country running.

Take Prince Edward Island, for example. From 1957 to 2023, it received $19.8 billion in equalization payments and contributed just $2 billion in taxes—a net gain of $17.8 billion.

Quebec tells a similar story. In 2023 alone, it received more than $14 billion in equalization payments, while continuing to run balanced or surplus budgets. From 1961 to 2023, Quebec received more than $200 billion in equalization payments, much of it funded by revenue from Alberta’s oil industry..

To be clear, not all federal transfers are equalization. Provinces also receive funding through national programs such as the Canada Health Transfer and

Canada Social Transfer. But equalization is the one most directly tied to the relative strength of provincial economies, and Alberta’s wealth has long driven that system.

By contrast to the have-not provinces, Alberta’s contribution has been extraordinary—an estimated 11.6 per cent annualized return on the federal

support it once received. Each Canadian receives about $485 per year from Alberta-generated oil revenues alone. Alberta is not the problem—it’s the

foundation of a prosperous Canada.

Still, when Alberta questions equalization or federal energy policy, critics cry foul. Premier Danielle Smith is not wrong to challenge a system in which the province footing the bill is the one most often criticized.

Yes, the oilpatch has flaws. Climate change is real. And many oil profits flow to shareholders abroad. But dismantling Alberta’s oil industry tomorrow wouldn’t stop climate change—it would only unravel the fiscal framework that sustains Canada.

The future must balance ambition with reality. Cleaner energy is essential, but not at the expense of biting the hand that feeds us.

And here’s the kicker: Donald Trump has long claimed the U.S. doesn’t need Canada’s products and therefore subsidizes Canada. Many Canadians scoffed.

But look at the flow of U.S. dollars into Alberta’s oilpatch—dollars that then bankroll Canada’s federal budget—and maybe, for once, he has a point.

It’s time to stop denying where Canada’s wealth comes from. Alberta isn’t the problem. It’s central to the country’s prosperity and unity.

Dr. Perry Kinkaide is a visionary leader and change agent. Since retiring in 2001, he has served as an advisor and director for various organizations and founded the Alberta Council of Technologies Society in 2005. Previously, he held leadership roles at KPMG Consulting and the Alberta Government. He holds a BA from Colgate University and an MSc and PhD in Brain Research from the University of Alberta.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

Alberta’s industrial carbon tax freeze is a good first step

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation is applauding Alberta Premier Danielle Smith’s decision to freeze the province’s industrial carbon tax.

“Smith is right to freeze the cost of Alberta’s hidden industrial carbon tax that increases the cost of everything,” said Gage Haubrich, CTF Prairie Director. “This move is a no-brainer to make Alberta more competitive, save taxpayers money and protect jobs.”

Smith announced the Alberta government will be freezing the rate of its industrial carbon tax at $95 per tonne.

The federal government set the rate of the consumer carbon tax to zero on April 1. However, it still imposes a requirement for an industrial carbon tax.

Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax.

The industrial carbon tax currently costs businesses $95 per tonne of emissions. It is set to increase to $170 per tonne by 2030. Carney has said he would extend the current industrial carbon tax framework until 2035, meaning the costs could reach $245 a tonne. That’s more than double the current tax.

The Saskatchewan government recently scrapped its industrial carbon tax completely.

Seventy per cent of Canadians said businesses pass most or some industrial carbon tax costs on to consumers, according to a recent Leger poll.

“Smith needs to stand up for Albertans and cancel the industrial carbon tax altogether,” Haubrich said. “Smith deserves credit for freezing Alberta’s industrial carbon tax and she needs to finish the job by scrapping the industrial carbon tax completely.”

-

International2 days ago

International2 days agoIce Surprises – Arctic and Antarctic Ice Sheets Are Stabilizing and Growing

-

International1 day ago

International1 day agoTrump envoy Steve Witkoff calls out neocons pushing for war with Iran

-

International2 days ago

International2 days agoTrump, Netanyahu reportedly at odds ahead of Middle East visit

-

Crime2 days ago

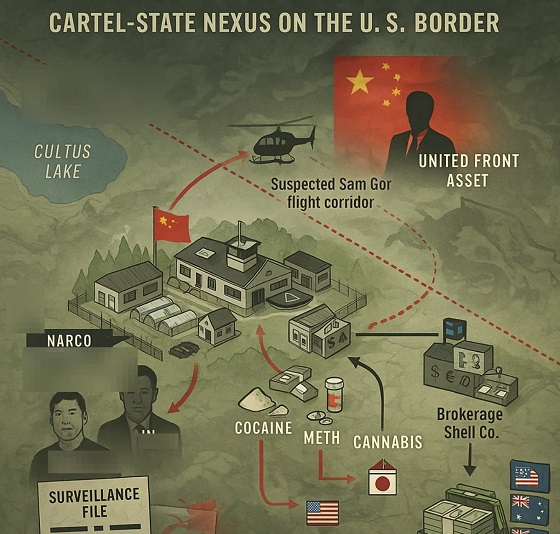

Crime2 days agoVeteran RCMP Investigator Warns of Coordinated Hybrid Warfare Targeting Canada

-

Alberta1 day ago

Alberta1 day agoIt’s not just Alberta flirting with western separatism now

-

Crime1 day ago

Crime1 day agoRCMP warns Central Alberta property owners of paving contractor scams

-

Business1 day ago

Business1 day agoU.S., China agree to 90-day tariff reduction after negotiations

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoIn Britain the “Thought Crime” Is Real