Business

The ESG Shell Game Behind The U.S. Plastics Pact

From the Daily Caller News Foundation

By Jack McPherrin and H. Sterling Burnett

In recent years, corporate coalitions have increasingly taken center stage in environmental policymaking, often through public-private partnerships aligned with environmental, social, and governance (ESG) goals that promise systemic change.

One of the most prominent examples is the U.S. Plastics Pact (USPP). At first glance, the USPP may appear to some as a promising solution for reducing plastic pollution. But in practice, it has encouraged companies to make changes that are more cosmetic than environmental—and in some cases, actively counterproductive—while increasing their control over the market.

The USPP, launched in 2020, consists of more than 850 companies, non-profits, research institutions, government agencies, and other entities working together to create a new “circular economy for plastics.” Dozens of major retailers and consumer goods companies—including Coca-Cola, Danone, Kraft Heinz, Target, and Unilever—have signed on as “Activators,” pledging to eliminate certain plastics, shift to recyclable packaging, and increase the use of recycled plastics.

Yet, rather than curbing plastic production or reducing waste, the USPP has led many companies to simply transition from polystyrene to polyethylene terephthalate (PET). This shift has been encouraged by claims that PET is more widely recyclable, easier to sort, and better aligned with existing U.S. recycling infrastructure.

However, polystyrene is more moldable, is recyclable, and has insulation properties that PET doesn’t. In addition, PET is approximately 30 percent heavier than polystyrene, meaning more material is required for the same functional use. Moreover, PET requires more energy and is more expensive to produce than polystyrene. And PET’s denser packaging increases transportation-related greenhouse gas emissions and raises costs even more—though these higher costs don’t bother USPP participants, as they simply pass them on to consumers.

Only 5 to 6 percent of all plastics in the United States are recycled. Even for PET products, the overall recycling rate remains low. Just one-third of PET bottles are recycled, while the recycling rate for many other PET products such as thermoforms is less than 10 percent. Most PET products end up in landfills.

This ineffective, costly, and counterproductive shift was not accidental. It reflects the broader incentives baked into ESG scoring systems that reward superficial compliance over substantive outcomes.

ESG frameworks reward companies financially and reputationally for achieving certain narrow targets such as reductions in single-use plastics or increases in the use of packaging that is technically recyclable. However, these metrics often fail to accurately assess total plastic use in a product’s lifecycle, associated emissions, and real-world recovery. A package that uses more plastic and energy—and therefore generates more emissions—may still earn high sustainability marks, so long as the plastic is recyclable in theory. This is a textbook example of greenwashing.

A closer look at the USPP reveals that some of the world’s top plastic users and producers—Coca-Cola, PepsiCo, and Nestlé—are among the Pact’s strongest backers. These corporations, which produce billions of PET containers per year, benefit substantially from signing onto agreements such as the USPP, adopting ESG standards, and pledging support for various green goals—even if they do not deliver any green results. In fact, a 2022 report found that a large majority of retail signatories to the USPP actually increased their consumption of virgin plastic from 2020 to 2021.

Many of these same companies fund the non-profit that organized the USPP: the Ellen MacArthur Foundation. This creates a feedback loop in which large companies shape sustainability standards to their own advantage, defining which materials are “acceptable,” reaping the rewards of ESG compliance, and marginalizing smaller firms that lack the resources to adapt.

For example, by promoting PET as the preferred packaging material, the USPP conveniently reinforces the existing supply chains of these multinational bottlers, while sidelining other materials such as polystyrene that may be more cost-efficient and suitable for specific applications. Smaller manufacturers, who can’t easily switch packaging or absorb the added costs, are effectively squeezed out of the marketplace.

The USPP has not built a circular economy. Rather, it has constructed a closed circle of corporate sponsors that gain reputational boosts and higher ESG scores on the backs of consumers, despite increasing energy and plastics use.

The USPP unites ESG financiers, government agencies, nonprofits, and the largest corporate polluters in a mutually beneficial arrangement. This system rewards compliance, deflects scrutiny, manipulates public trust, eliminates free-market competition, stifles innovation, and increases costs to consumers—all while creating more waste.

Policymakers and consumers alike must recognize that ESG-aligned coalitions such as the U.S. Plastics Pact are nothing more than corporate lobbying groups disguised as sustainability initiatives. They do not improve environmental quality, but they do profit immensely from the illusion of doing so.

Jack McPherrin ([email protected]) is a Research Fellow for the Glenn C. Haskins Emerging Issues Center and H. Sterling Burnett, Ph.D., ([email protected]) is the Director of the Arthur B. Robinson Center on Climate and Environmental Policy, both at The Heartland Institute, a non-partisan, non-profit research organization based in Arlington Heights, Illinois.

Alberta

Alberta’s industrial carbon tax freeze is a good first step

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation is applauding Alberta Premier Danielle Smith’s decision to freeze the province’s industrial carbon tax.

“Smith is right to freeze the cost of Alberta’s hidden industrial carbon tax that increases the cost of everything,” said Gage Haubrich, CTF Prairie Director. “This move is a no-brainer to make Alberta more competitive, save taxpayers money and protect jobs.”

Smith announced the Alberta government will be freezing the rate of its industrial carbon tax at $95 per tonne.

The federal government set the rate of the consumer carbon tax to zero on April 1. However, it still imposes a requirement for an industrial carbon tax.

Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax.

The industrial carbon tax currently costs businesses $95 per tonne of emissions. It is set to increase to $170 per tonne by 2030. Carney has said he would extend the current industrial carbon tax framework until 2035, meaning the costs could reach $245 a tonne. That’s more than double the current tax.

The Saskatchewan government recently scrapped its industrial carbon tax completely.

Seventy per cent of Canadians said businesses pass most or some industrial carbon tax costs on to consumers, according to a recent Leger poll.

“Smith needs to stand up for Albertans and cancel the industrial carbon tax altogether,” Haubrich said. “Smith deserves credit for freezing Alberta’s industrial carbon tax and she needs to finish the job by scrapping the industrial carbon tax completely.”

Alberta

Canada’s oil sector is built to last, unlike its U.S. counterpart

This article supplied by Troy Media.

By Rashid Husain Syed

By Rashid Husain Syed

Low-cost oilsands give Canada a crucial edge as U.S. shale oil struggles with rising costs

While global oil markets have rebounded slightly on news of a U.S.-China trade truce, not all producers are equally positioned to benefit. In North America, the contrast is clear: Canada’s oil sector is built for stability, while the U.S. industry is showing signs of strain.

Canada’s oil production is dominated by the oilsands —capital intensive to build, but efficient and low-cost to maintain. Oil sands projects involve mining or steaming oil from sand-rich deposits and can produce for decades, unlike U.S. shale wells that decline rapidly and require constant reinvestment. This gives Canadian producers a structural edge during market downturns.

“The largest companies here in Canada … they have cost structures that are among the best in the world,” said Randy Ollenberger of BMO Capital Markets. “They can withstand WTI (West Texas Intermediate) prices in the range of US$40 and still have enough cash ow to maintain production.”

Mid-sized conventional producers in Canada often break even at US$50 to US$55 per barrel. Major players like Canadian Natural Resources can operate sustainably in the low-to-mid-US$40 range. A break-even price is the minimum oil price needed to cover production costs and avoid operating at a loss.

“We’re not planning on shutting any rigs down or changing our plans, yet,” said Brian Schmidt, CEO of Tamarack Valley Energy. “And it largely is

because our company can tolerate, and is quite profitable, at low prices.” He added: “I think we had already, even before the downturn, put ourselves into a defensive position.”

The data supports that confidence. According to Statistics Canada, 2024 was a record year: crude oil and equivalent output rose 4.3 per cent to 298.8 million cubic metres (about 1.88 billion barrels); exports increased five per cent to 240.4 million cubic metres; and shipments to non-U.S. markets jumped nearly 60 per cent, aided by the completion of the Trans Mountain pipeline expansion.

Nearly 89 per cent of Canada’s oil exports still flow to the United States, but structurally, the two industries are diverging fast.

In the U.S., the shale-driven oil boom is losing steam. Production dropped from a record 13.465 million barrels per day in December 2024 to 13.367 million, according to the U.S. Energy Information Administration.

Industry leaders are warning of a turning point.

“It is likely that U.S. onshore oil production has peaked and will begin to decline this quarter,” said Travis Stice, CEO of Diamondback Energy, the largest independent producer in the Permian Basin. The company is “dropping three rigs and one crew this quarter.”

ConocoPhillips, another major player, is also pulling back. It reduced its capital budget to between US$12.3 billion and US$12.6 billion—down from US$12.9 billion—citing “economic volatility.” Rig counts are falling as well, according to oilfield services company Baker Hughes.

The core challenge is cost. A Federal Reserve Bank of Dallas survey found that Texas producers’ average break-even price is around US$65, the cost to drill replacement wells ranges from US$50 to US$65, and growth drilling requires prices between US$78 and US$85.

Even after the recent rebound—sparked by the May 12 U.S.-China trade truce—West Texas Intermediate sits at around US$63.07, below what many U.S. firms need to expand operations.

Shale’s short life cycles, higher reinvestment demands and rising capital discipline are colliding with lower prices. The U.S. sector is being forced to slow down.

Canada’s oil sector isn’t just surviving—it’s adapting and growing in a volatile market. With lower ongoing costs, long-life assets and increased export flexibility, Canadian producers are proving more resilient than their American peers.

With tens of thousands of jobs across Canada tied to the oilpatch, the sector’s ability to remain profitable through downturns is critical to Canada’s economy, government revenues and energy security.

In a world of unpredictable oil prices, Canada is playing the long game—and winning.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta2 days ago

Alberta2 days agoPremier Smith seeks Alberta Accord: Announces new relationship with Ottawa

-

Energy2 days ago

Energy2 days agoIt’s time to get excited about the great Canadian LNG opportunity

-

Crime2 days ago

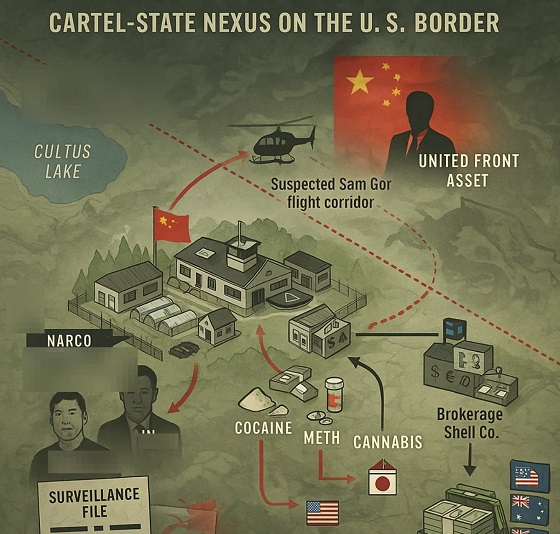

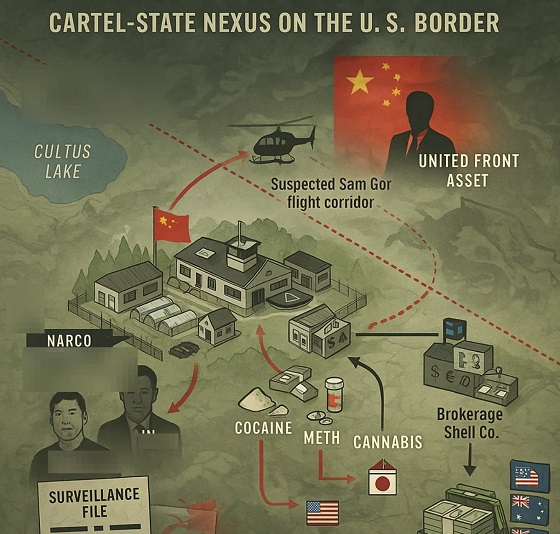

Crime2 days agoInside B.C.’s Cultus Lake Narco Corridor — How Chinese State-Linked Syndicates are Building a Narco Empire in Canada

-

International1 day ago

International1 day agoIce Surprises – Arctic and Antarctic Ice Sheets Are Stabilizing and Growing

-

Energy2 days ago

Energy2 days agoIs the Carney Government Prepared to Negotiate a Fair Deal for the Oil, Gas and Pipeline Sectors

-

Alberta1 day ago

Alberta1 day agoEnergy projects occupy less than three per cent of Alberta’s oil sands region, report says

-

Health2 days ago

Health2 days agoJay Bhattacharya Closes NIH’s Last Beagle Lab

-

Business2 days ago

Business2 days agoWelcome to Elon Musk’s New Company Town: ‘Starbase, TX’ Votes To Incorporate