Energy

‘War On Coal Is Finally Over’: Energy Experts Say Trump Admin’s Deregulation Agenda Could Fuel Coal’s ‘Revival’

From the Daily Caller News Foundation

By Audrey Streb

Within the first months of his second administration, President Donald Trump has prioritized “unleashing” American energy and has already axed several of what he considers to be burdensome regulations on the coal industry, promising it’s “reinvigoration.”

Trump signed an executive order on April 8 to revive the coal industry, and shortly after moved to exempt several coal plants from Biden-era regulations. Though it has become a primary target of many climate activists, coal has been historically regarded as readily available and affordable, and several energy policy experts who spoke with Daily Caller News Foundation believe Trump has the cards necessary to strengthen the industry.

“When utility bills are skyrocketing or blackouts are happening in winter, people are going to want reliable power back,” Amy Cooke, co-founder and president of Always on Energy Research and the director of the Energy and Environmental Policy Center told the DCNF. “The beauty of coal is that it allows for affordable, reliable power, which is absolutely crucial to economic prosperity, and in particular, innovation.”

“I think the number one, most significant threat to humanity is no power,” Cooke said, adding that coal is a vital contributor to the nation’s “baseload power.”

Following his executive order, Trump in early April granted a two-year exemption for nearly 70 coal plants from a Biden-era rule on air pollution that required them to reduce certain air pollutants. The Environmental Protection Agency (EPA) said that the move would “bolster coal-fired electricity generation, ensuring that our nation’s grid is reliable, that electricity is affordable for the American people, and that EPA is helping to promote our nation’s energy security.”

Shortly after, skepticism swirled surrounding whether or not the coal industry would be able to experience a revival, and whether it would be economically savvy to pursue one.

Energy generated from burning coal only powers roughly 16% of the U.S., though 40 states are dependent on coal, according to data from America’s Power. Energy generation through coal reached a record low in 2023, a Rhodium Group study reported. In 2021, however, coal was the primary source of energy for 15 states, according to the U.S. Energy Information Administration.

“We can lead the world in innovation,” Cook told the DCNF, referencing developments in natural gas and nuclear power as beneficial. “But you have to have coal. It has to be part of the mix.”

“It’s insane that we would shut down any base load power right now, when the demand for power is so high,” Cooke added. She further referenced the North American Electric Reliability Corporation’s 2024 report and research from Always on Energy Research that have projected rolling blackouts to begin across the U.S. by 2028.

As American energy demand continues to climb, the odds of impending blackouts would increase if the supply fails to grow at the same rate. The push toward renewable energy sources, in addition to stringent environmental regulations approved under former President Joe Biden, may have contributed to the slower growth of energy supply currently being experienced in the U.S.

Immediately after returning to the White House, Trump declared a national energy emergency, stating that “the integrity and expansion of our Nation’s energy infrastructure” is “an immediate and pressing priority for the protection of the United States’ national and economic security.”

“We looked at it and predict that there will be periods of blackouts of 24 hours or more,” Cook told the DCNF.

She further noted that “the cheapest power is the power you’ve already paid for,” arguing for the continuation of existing coal plants and the reopening of ones that have been closed.

“The only people who think coal is bad are those who view it through the lens of carbon emissions only, and that is no way to do energy policy,” Cooke said, arguing that it is necessary to adopt a “holistic” approach to energy generation, given the nation’s projected energy crisis.

“The American people need more energy, and the Department of Energy is helping to meet this demand by unleashing supply of affordable, reliable, secure energy sources – including coal,” Department of Energy Secretary Chris Wright said in an April 9 statement. “Coal is essential for generating 24/7 electricity,” he added, “but misguided policies from previous administrations have stifled this critical American industry. With President Trump’s leadership, we are cutting the red tape and bringing back common sense.”

The president has also said that he envisions greater job opportunities for coal miners with the industry’s expansion, stating during an April 8 press conference that the workers are “really well-deserving and great American patriots.”

“For years, people would just bemoan this industry and decimate the industry for absolutely no reason,” Trump added.

“Miners can wake up today for the first time in a decade and their spouses and families will realize they have a job tomorrow,” reporter Bob Aaron said in a video shared on X. They can “hear a president of the country announce that the war on coal is over.”

“I really anticipate a revival in the coal industry in the United States under Trump,” David Blackmon, an energy and policy writer who spent 40 years in the oil and gas business told the DCNF. He pointed to the Trump administration loosening restrictions on coal, adding that the Biden administration made it “near impossible” to build new coal plants due to aggressive climate rules.

Under Biden’s signature climate bill, the Inflation Reduction Act, the U.S. prioritized renewable energy generation and subsidization, resulting in a hefty price tag for taxpayers who had to foot the bill for several environmental initiatives, including hundreds of millions of dollars for solar panel construction in some of the nation’s least-sunny locations.

“The cheapest, the most affordable thing to do is to keep our current infrastructure online,” André Béliveau, Senior Manager of Energy Policy at the Commonwealth Foundation, told the DCNF. “Coal remains one of, if not, the most affordable energy source we have.”

“You’re forcing retirement of full-time energy sources and trying to replace them with part-time energy sources, and that’s not going to work,” Béliveau continued, referencing renewable energy avenues such as wind and solar. “We can’t run a full-time economy on part-time energy.”

Daily Caller

US Energy Secretary Chris Wright Has To Clean Up Joe Biden’s Mess and refill the Strategic Petroleum Reserve

From the Daily Caller News Foundation

By David Blackmon

Joe Biden and his appointees took an abundance of costly and damaging policy actions during his four-year term in office. Fortunately, that damaging agenda was limited to a single term presidency by voters last November who had grown weary of footing the massive bills for it all in the form of constantly increasing prices for all forms of energy.

Now the task of cleaning it all up and repairing the damage falls to President Donald Trump and his appointees. In another fortunate development for America, the President has chosen an eager and extremely talented array of energy-related appointees, including EPA Administrator Lee Zeldin, Interior Secretary Doug Burgum, and Energy Secretary Chris Wright.

One of the costliest actions taken by ex-President Biden related to U.S. national security came when he decided to raid the Strategic Petroleum Reserve by using it as a campaign tool to influence the 2022 mid-term elections. Early that year, Biden invoked a program to rapidly deplete the contents of the SPR, pulling 1 million barrels per day from the underground salt caverns which hold the crude for 180 days in hopes of lowering gas prices at the pump.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

In an interview this week with radio host Glenn Beck, Secretary Wright revealed that, by drawing the volumes down so rapidly, Biden caused damage to the integrity of those salt caverns so severe that his Energy Department will now have to spend a big piece of its budget repairing the infrastructure before the caverns can be refilled. “[Biden] flooded the market with oil, reduced the price of oil in the short term but at the cost of U.S. strategic positioning, and they damaged the facilities in the Strategic petroleum reserve by draining them so fast,” Wright told Beck, adding, “We have to spend over $100 million to repair the damage of the Strategic Petroleum Reserve that wasn’t built for that.”

For readers who may not be aware, Congress and President Gerald Ford authorized the creation of the SPR in 1975 in the wake of the first Arab Oil Embargo of 1973-74 That embargo caused severe shortages of gasoline, along with price spikes across the United States. Congress intended the SPR as a tool whose careful deployment would enhance and protect national security in times of real emergencies, not one to be used for cynical political purposes.

“It’s for when a very bad day happens,” Wright put it to Beck. “The world literally runs on oil. If you don’t have oil, you’re screwed in everything you do – economics, defense, health care, anything.”

In March, Secretary Wright unveiled an aggressive plan to refill the SPR, estimating the cost of doing so at the $70 per barrel price that prevailed at the time to be about $20 billion. He also estimated it would take 4 to 6 years to complete the process due to the magnitude of Biden’s unwise withdrawals. Filling the reserve is not something that can be done all in a single transaction. Rather, it is a complex process governed by regulations which require DOE to solicit competitive bids for relatively small lots of crude.

“By design, it’s much slower to fill it than to drain it,” Wright told Beck. “It will take us, going flat out, four, five, six years to refill the Strategic Petroleum Reserve. We are dead set committed to do it, but we’ve compromised our national security for years to get a little bit of an electoral advantage in 2022.”

It should be noted here that Wright would love to take advantage of current low oil prices, which have dropped to around $60/bbl today. Obviously, the same “buy low, sell high” philosophy followed by smart stock investors applies to buying and selling crude oil, too.

But DOE’s buyback program cannot begin until the damage caused by Biden’s careless disregard for national security has been repaired. Doing that will require months, during which time oil prices could rise or drop significantly.

“Energy is the infrastructure of life,” Wright reminded Beck. “You can’t use it for politics.”

But unfortunately for U.S. national security, Joe Biden did just that. The mess he left behind is Wright’s to clean up.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Energy

It’s time to get excited about the great Canadian LNG opportunity

By Stewart Muir

By Stewart Muir

Canada has a rare window to join the big leagues of LNG exporters—Qatar, Australia, and the United States are not waiting around, and neither should we.

I sometimes catch myself staring out over the waters of British Columbia’s coastline — so calm, so vast, so brimming with unspoken opportunity — and I can’t help but wonder how anyone could fail to notice the promise that Liquefied Natural Gas (LNG) represents for our nation’s future. This country sits atop some of the largest gas reserves on Earth, and we have two coasts eager to connect our product to global markets.

I’m a quietly enthusiastic type by nature, and I don’t often indulge in the “I-told-you-so” routine, but whenever I encounter someone who just hasn’t cottoned on to the excitement around LNG, I feel compelled to stage a gentle intervention.

In my day-to-day role as CEO of Resource Works, I work with communities from Fort St. John to Kitimat, and beyond. Let me assure you, if you want to see Canadians at work, proud of their craft, and eyeing a brighter future, you’ll find them along the pipeline routes and port terminals that are part of our budding LNG industry. And they’re just as commonly found in Vancouver, Victoria and the other cities, just harder to spot with no blue coveralls.

I’ve been following the natural gas story in British Columbia for more than a quarter of a century, going back to my days in the media field. As an editor at The Vancouver Sun, I created the paper’s first-ever energy beat after we noticed something big was stirring in the North East gas fields. It turned out to be an industry animated by regulatory innovation, rich geology, ambitious investors, and some of the most capable people you’ll ever meet.

When talk of LNG exports began to stir in 2011, I dove in with both feet. Over the past 15 years, I’ve followed the LNG file across Canada, around the world, and deep into the heart of British Columbia.

Along the way, I’ve met First Nations chiefs who proudly showed me the schools and businesses they built through new partnerships. I’ve also sat down with those who remain skeptical and had honest, sometimes searching conversations. I’ve learned something from all of them. This is an industry that, at its best, brings people together to solve problems, create opportunity, and build a future worth caring about.

Why am I still so enthused after all these years? LNG is not a flash in the pan, for starters. Through cyclical ups and downs—natural phenomena in any commodity game—international forecasts consistently show that LNG demand won’t be evaporating tomorrow or, quite likely, for several tomorrows yet. The International Energy Agency, the Canada Energy Regulator, and even the U.S. Energy Information Administration all point to steady growth in global LNG trade.

On top of that, if you follow the money, you’ll see billions of dollars flowing into new regasification terminals and record orders for LNG carriers. I may be old-fashioned, but I’ve always found that when so many investors plunk down their capital in one place, it’s seldom a fluke. The world has more than 700 LNG ships plying the seas these days, and hundreds more under construction. That’s not a small bit of confidence.

And let’s talk local: from where I sit, Canada’s jobs outlook tied to LNG looks like a real tonic for communities seeking new opportunities. Construction alone can employ entire regions. Then come the careers that last decades—plant operators, engineers, port and shipping managers, the works. It’s the sort of diversified prosperity that a resource economy yearns for.

We’ve even seen First Nations communities take equity stakes in major LNG projects, forging new partnerships that benefit everyone involved. That’s the model of inclusive economic development that Canadians like to talk about. It’s called walking the walk.

Those voices of skepticism — bless their hearts — sometimes say, “But what about price volatility? The commodity cycles? Are we sure this is sustainable?” Truthfully, no commodity is immune to upswings and downswings. But open a newspaper — digitally or in paper form, your choice— and you’ll find that countries all over the world are expanding their LNG-import infrastructure. Many of them, especially in Asia and Europe, see Canada as a steady, well-regulated, and (importantly) speedy supplier.

Yes, “speedy” might be an odd descriptor for us easygoing Canadians, but let’s not overlook that a West Coast port is only about eight or nine sailing days from major Asian markets, versus more than 20 from the U.S. Gulf Coast. You’d think we’d have lines of ships lined up right now, just for that advantage.

There’s another subtlety that some folks overlook. Right now, much of our gas still flows to the United States, often at discounted prices, only to be converted into LNG down there and sold globally at a premium. If that doesn’t make you shake your head in wonder, I’m not sure what will. Canadians have every reason to want to keep some of that up-chain value right here at home, funneling more of that revenue into local jobs and public coffers. That’s exactly the sort of well-to-customer supply chain we’re poised to build.

And if you’re still not impressed, consider the big jolt to GDP whenever a massive energy project crosses the finish line. Look no further than the Trans Mountain pipeline expansion: once it was substantially complete last year, the national GDP got a measurable jolt. It’s extremely rare that a single anything shows up that way. Now, with the first shipment of Canadian LNG preparing to leave Kitimat in the coming weeks, we can expect a repeat performance. It’s the real economic equivalent of an encore, if you will. And who doesn’t love an encore that boosts paycheques and government revenues?

Canadians may be known worldwide for politeness and hockey, but let’s not forget that boldness is also in our national DNA. Building a robust LNG sector that ties Western and Eastern Canada to major global markets is about as bold an economic strategy as we could pursue right now. Some might call it visionary, others might say it’s just common sense in a world that still demands substantial amounts of energy. Either way, Canada has a rare window to join the big leagues of LNG exporters—Qatar, Australia, and the United States are not waiting around, and neither should we.

At the end of the day, seeing Canadians capture more of the value from our natural resources rather than shipping it across the border at a discount is, for me, both pragmatic and patriotic. It’s the kind of deal that makes you wonder why anyone would hesitate. Perhaps that hesitation is just a bump in the road of public discourse—something we can gently, politely, and persistently overcome.

I, for one, am excited for the first shipment of LNG out of Canada’s West Coast, due any week now. A top executive with the project once whispered to me that the maiden cargo would be worth $100 million, but lately I’m hearing a single shipload is now probably worth double that.

So yes, I’m looking forward to the day when it’s not just a handful of tankers leaving our ports, but a regular fleet serving global customers. It will lift up the whole country, just as it has contributed to America’s tearaway economy in recent years and elevated Qatar from desert outpost to World Cup host nation.

Soon, maybe all the doubters will have recognized the obvious — and joined the rest of us on the bandwagon with front-row seats to Canada’s LNG future. Sure, I’m biased, but only because the facts keep reinforcing that this sector is poised to do a world of good for Canadians from coast to coast.

-

Alberta2 hours ago

Alberta2 hours agoPremier Smith seeks Alberta Accord: Announces new relationship with Ottawa

-

Energy1 hour ago

Energy1 hour agoIt’s time to get excited about the great Canadian LNG opportunity

-

Crime17 mins ago

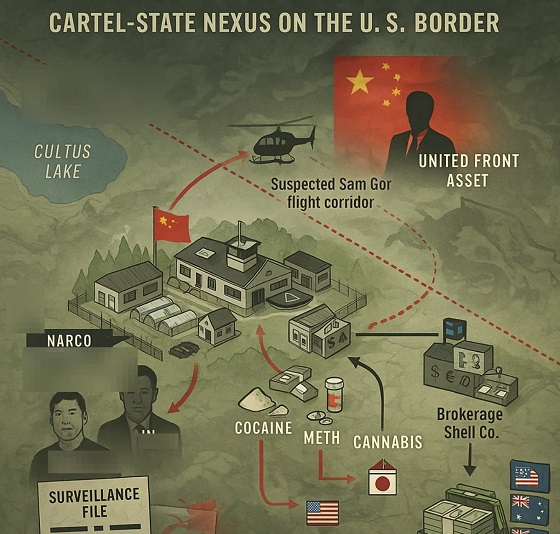

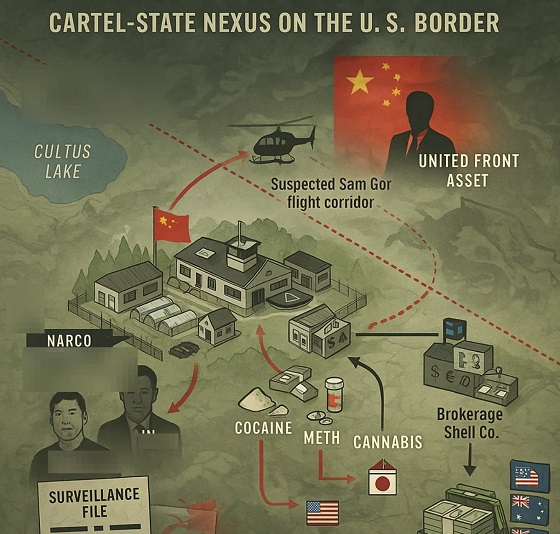

Crime17 mins agoInside B.C.’s Cultus Lake Narco Corridor — How Chinese State-Linked Syndicates are Building a Narco Empire in Canada

-

Energy4 hours ago

Energy4 hours agoIs the Carney Government Prepared to Negotiate a Fair Deal for the Oil, Gas and Pipeline Sectors

-

Health5 hours ago

Health5 hours agoJay Bhattacharya Closes NIH’s Last Beagle Lab

-

Business6 hours ago

Business6 hours agoWelcome to Elon Musk’s New Company Town: ‘Starbase, TX’ Votes To Incorporate

-

Daily Caller2 days ago

Daily Caller2 days agoStates Attempting To Hijack National Energy Policy

-

Business1 day ago

Business1 day agoFrom ‘Elbows Up’ To ‘Thumbs Up’