Business

What if Canada’s Income Tax Rate Was Zero?

By David Clinton

By David Clinton

It won’t happening. And perhaps it shouldn’t happen. But we can talk.

By reputation, income tax is an immutable fact of life. But perhaps we can push back against that popular assumption. Or, to put it a different way, thinking about how different things can be is actually loads of fun.

That’s not to suggest that accurately anticipating the full impact of blowing up central economic pillars is simple. But it’s worth a conversation.

First off, because they’ve been around so long, we can easily lose sight of the fact that income taxes cause real economic pain. The median Canadian household earns around $85,000 in a year. Of that, some 13 percent ($11,000) is lost to federal income tax. Provincial income tax and sales taxes, of course, drive that number a lot higher. If owning a house is out of reach for so many Canadians, that’s one of the biggest reasons why.

Having said that, the $200 billion or so in personal income taxes that Canada collects each year represents around 40 percent of federal spending. In fact, in the absence of other policy changes, eliminating federal personal income tax would probably lead to significant drops in business tax revenues too. (I could see many small businesses choosing to maximize employee salaries to reduce their corporate tax liability.)

So if we wanted to cut taxes without piling on even more debt, we’d need to replace that amount either by finding alternate revenue sources or by cutting spending. If you’ve been keeping up with The Audit, you’ve already seen where and how we might find some serious budget savings in previous posts.

But for fascinating reasons, some of that $200 billion (or, including corporate taxes, $300 billion) shortfall could be made up by wiping out income tax itself. How’s that?

For one thing, many government entitlements and payouts essentially exist to make up for income lost through taxes. For example, the federal government will spend around $26 billion on child tax credits (CCB) in 2025. Since those payments are indexed to income, eliminating federal income tax would, de facto, raise everyone’s income. That increase would drop CCB spending by as much as $15 billion. Naturally, we’d want to reset the program eligibility thresholds to ensure that low-income working families aren’t being hurt by the change, but the savings would still be significant.

There are more payment programs of that sort than you might imagine. Without income taxes to worry about:

- The $6.2 billion GST/HST credit would cost us around $3 billion less each year.

- The Canada Workers Benefit (CWB) could cost $1.5 billion dollars less.

- The Old Age Security (OAS) Clawback would likely generate an extra billion dollars each year in taxes.

- The Guaranteed Income Supplement for low-income OAS recipients could save $4 billion a year.

Even when factoring in for threshold recalculations to protect vulnerable families from unintended consequences, all those indirect consequences of a tax cut could easily add up to $20 billion in federal spending cuts. And don’t forget how the cost of administering and enforcing the income tax system would disappear. That’ll save us most of the $11 billion CRA costs us each year.

Nevertheless, last I heard, $30 billion (in savings) was a long, long way from $300 billion (in tax revenue shortfalls). No matter how hard we look, we’re not going to find $270 billion in government waste, fraud, and marginal programs to eliminate. And adding more government debt will benefit exactly no one (besides bond holders).

Ok then, let’s say we can find $100 billion in reasonable cuts (see The Audit for details). That would get us close to half way there. But it would also generate some serious economic turbulence.

On the one hand, such cuts would require dropping hundreds of thousands of workers off the federal payroll¹. It would also exert powerful downward pressure on our gross domestic product (GDP).

On the plus side however, a drop in government borrowing of this scale would likely reduce interest rates. That, in turn, could spark private investment activities that partially offset the GDP hit. If you add the personal wealth freed up by our income tax cuts to that mix, you’d likely see another nice GDP bump from sharp increases in household spending and investments.

Precisely predicting how a proposed change might affect all these moving parts is hard. Perhaps the ideal scenario would involve 20 percent or 50 percent cuts to taxes rather than 100 percent. Or maybe we’d be better off by playing around with sales tax rates. But I’m not convinced that anyone is even seriously and objectively thinking about our options right now.

One way or the other, the impact of such radical economic changes would be historic. I think it would be fascinating to develop data models to calculate and rank the macro economic consequences of applying various combinations of variables to the problem.

But taxation is a problem. And it’d be an important first step to recognize it as such.

Although on the bright side, as least they wouldn’t have to worry about delayed or incorrect Phoenix payments anymore.

Business

LEGO to invest $366 million on major U.S. expansion

Quick Hit:

The LEGO Group is expanding its U.S. footprint with a $366 million investment to build a 2-million-square-foot warehouse in Virginia. The move will create 305 new jobs and deepen the company’s commitment to the United States.

Key Details:

-

The new warehouse and distribution center will be built in Prince George County, complementing LEGO’s upcoming factory in neighboring Chesterfield County that’s set to open in 2027.

-

Virginia secured the project through a $2.53 million Commonwealth Opportunity Fund grant, with additional support from state programs including the Virginia Jobs Investment Program and the Port of Virginia’s economic development incentives.

-

LEGO’s Chief Operations Officer Carsten Rasmussen said the center will “bring greater flexibility” to the company’s North American supply chain and reduce both customer wait times and environmental impact.

Diving

LEGO is expanding in Virginia! This new $366M investment in Prince George County creates 305 new jobs, strengthening our partnership and Virginia’s status as the top state for business. Virginia is where global companies and iconic brands like @LEGO_group can thrive, grow, and… pic.twitter.com/6rzydVIlRZ

— Glenn Youngkin (@GlennYoungkin) May 8, 2025

Deeper:

The LEGO Group will invest $366 million to build a 2 million-square-foot warehouse and distribution center in Prince George County, Virginia, a move expected to create 305 new jobs, according to a Thursday announcement by Governor Glenn Youngkin.

The project marks another milestone in LEGO’s ongoing U.S. expansion, following the 2022 announcement of its Chesterfield County factory currently under construction. The company’s operations in Virginia are projected to create more than 2,000 jobs total when both sites are fully up and running.

“The LEGO Group is not just a household name, it’s a symbol of creativity, innovation, and quality that resonates globally,” said Governor Youngkin. “Three years after choosing Virginia to establish its U.S. manufacturing plant, the LEGO Group’s decision to expand into Prince George County is an exciting new chapter in this partnership.”

LEGO’s global Chief Operations Officer, Carsten Rasmussen, said the regional distribution center “will shorten our supply chain in the region–reducing lead times for our customers as well as our environmental impact.” He praised the continued partnership with the Commonwealth.

State economic officials credited Virginia’s workforce and infrastructure for helping land the deal. “This investment brings high-quality jobs to Prince George County and reflects our broader commitment to building healthy, vibrant communities,” said Secretary of Commerce and Trade Juan Pablo Segura.

Virginia lawmakers representing the area praised the announcement. State Senator Lashrecse Aird said the investment means “new opportunities for families and a stronger foundation for our community.” Delegate Carrie Coyner echoed that sentiment, calling it “a testament to the kind of community we’ve built.”

Business

From ‘Elbows Up’ To ‘Thumbs Up’

From the National Citizens Coalition

National Citizens Coalition Slams Carney-Trump Meeting as ‘Insulting’ About-Face After Fear-Mongering Campaign Rhetoric

CANADA – From “elbows up” to thumbs up in record time.

The National Citizens Coalition (NCC) condemns Prime Minister Mark Carney’s cozy meeting with U.S. President Donald Trump, calling it a stark contradiction of the anti-American rhetoric that fueled Carney’s election campaign. The NCC asserts that Carney’s deferential White House visit undermines the combative pledges made to Canadians, revealing how the Liberals leveraged Trump’s tacit endorsement and the ‘Rally Around the Flag effect’ to secure their minority government.

During the April 2025 federal election, Carney and the Liberal Party campaigned on a platform of staunch resistance to Trump’s trade war and his provocative “51st state” rhetoric, inflaming tensions by warning that Trump sought to “break us so America can own us.” This messaging galvanized voters on the left, particularly the collapsing NDP base and many over-55s, with polls showing a surge in Liberal support driven entirely by anti-Trump sentiment. Yet, just days after securing victory, Carney’s decision to behave in stark contrast to such rhetoric betrays the trust of Canadians who believed in his hardline stance, and in particular, betrays the young Canadians who voted in defiance of “51st state” nonsense and American election interference, but who also had major additional priorities that have been ignored by a decade of Liberal ruin.

“Mark Carney sold Canadians a story of aggressive defiance against Trump, but this meeting proves he’s more interested in reaping the rewards than holding convictions,” says NCC President Peter Coleman. “Carney’s campaign leaned heavily on fearmongering about Trump, yet here he is shaking hands, laughing, and all but sitting idly by as he’s insulted, with the very man he claimed threatened our sovereignty. This isn’t leadership—it’s hypocrisy.”

The NCC contends that Trump’s public comments, including his refusal to rule out making Canada the 51st state, however flippant the bargaining tactic, were strategically exploited by the Liberals to consolidate left-leaning voters fearful of Conservative leader Pierre Poilievre’s perceived Trump-like style.

“Trump’s shadow loomed large over this election, and the Liberals milked it for every vote,” Coleman adds. “Canadians deserve to know if Carney’s tough talk was just a ploy to ride anti-Trump sentiment to power, only to cozy up to him afterward. This smells like a backroom deal between the two, that benefited the Liberals at the expense of much-needed hope and change, and honest and ethical conversations about the need for renewed pride in who we are, and a return to Canadian sovereignty.”

The NCC demands Carney explain how this meeting aligns with his fear-mongering on the campaign trail. Canadians deserve transparency about more of Carney’s true motives, which also may not match his statements and behaviours to date.

The National Citizens Coalition calls on all Canadians to hold Carney accountable for this cynical about-face. “We will not stand idly by while Carney exploits sovereignty concerns and election interference for political points,” Coleman concludes. “If this level of decorum had been any kind of consistent, if he hadn’t just run a fearful, pandemic-style campaign that robbed so many Canadians of hope and further inflamed alienation in the West, that’s one thing. But it’s time to reclaim the Canadian Dream from low-cunning leaders who say one thing and do another. He may be better house-broken than Trudeau, and on that, there is room for faint praise. But who really is Mark Carney? Why did the legacy media seem so disinterested in vetting him? And what does he really believe?”

About the National Citizens Coalition: Founded in 1967, the National Citizens Coalition is Canada’s pioneer non-profit conservative organization, dedicated to championing common-sense values, defending taxpayer interests, and promoting a strong, proud, and free Canada.

-

Crime1 day ago

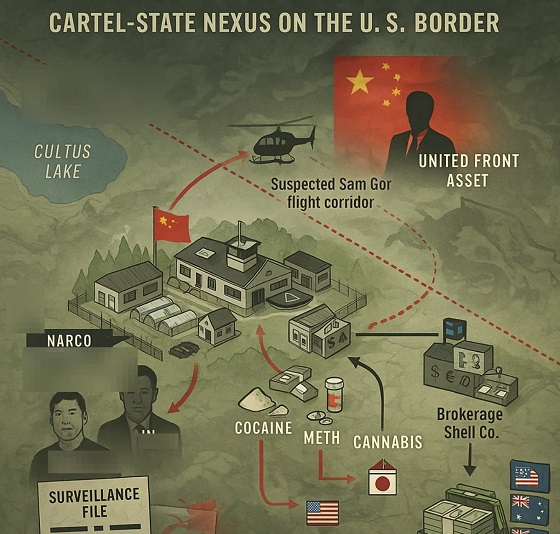

Crime1 day agoHow the CCP’s United Front Turned Canada’s Legal Cannabis Market into a Global Narcotics Brokerage Network

-

Business2 days ago

Business2 days agoTrump announces UK will fast-track American products under new deal

-

COVID-191 day ago

COVID-191 day agoCanada’s top doctor signed oath to withhold COVID info that could ‘embarrass’ Trudeau’s cabinet: records

-

espionage2 days ago

espionage2 days agoHong Kong Police Detain Relatives of Canadian Candidate Targeted by Beijing Election Interference

-

Energy2 days ago

Energy2 days agoOntario Leads the G7 by Building First Small Modular Reactor

-

International1 day ago

International1 day agoFirst American pontiff says ‘build bridges’ to peace

-

Alberta1 day ago

Alberta1 day agoAlberta Precipitation Update

-

Business21 hours ago

Business21 hours agoReal Challenges Await Carney